Forex futures market speculative positioning data from the CFTC Commitments of Traders report as of the close on Tuesday October 10, 2014:

- EUR net short 155K vs short 146K prior

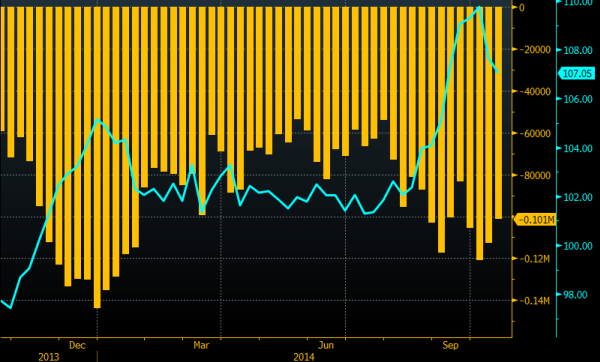

- JPY net short 101K vs 113K short prior

- GBP net short 3K vs long 1K prior

- AUD net short 30K vs short 26K prior

- CAD net short 16K vs short 7K prior

- CHF net short 18K vs short 12.5K prior

- NZD net short 2k vs flat prior

Only against the yen did interest in the dollar wane.

CFTC JPY shorts 17 10 2014

Obviously the report was up to last Tuesday so it doesn’t include whatever carnage happened Wednesday and Thursday. That will be an interesting report next week.

What it does still show is that the market loves bucks and until they really start believing that there’s a possibility of the economy turning south I don’t see them giving up these positions to any great degree.