USDCAD

The Bank of Canada's (BOC) rate statement yesterday provided a surprise for the CAD. Yes, the BOC, left rate's unchanged but the accompanying statement led to some bearish CAD selling as two things were stressed which stood out, namely falling Oil prices and falling business investment. You can read the full statement here. This is some backpedaling going on by the BOC and I expect to see some more bearish action on CAD over the next session at least. There are a couple of caveats to this and the first one is the final OPEC decision. If they surprise markets with a large cut (>+1.5 million bpd), then Oil is going to rally from current levels and put a bid under CAD. Perhaps the rumour from Oman was an early leak to test the waters on a smaller cut. See here. That would make sense to do if you wanted to see how the oil markets would react before a definite move. However, that is purely speculation on my part.

The second decisive factor for CAD today will be the BOC's governor Poloz speaking. He can skew the pitch on a bearish CAD picture, but I suspect he will only add to the bearish outlook as he repeats the statement's message. However, Oil will be a factor in Poloz's tone for sure.

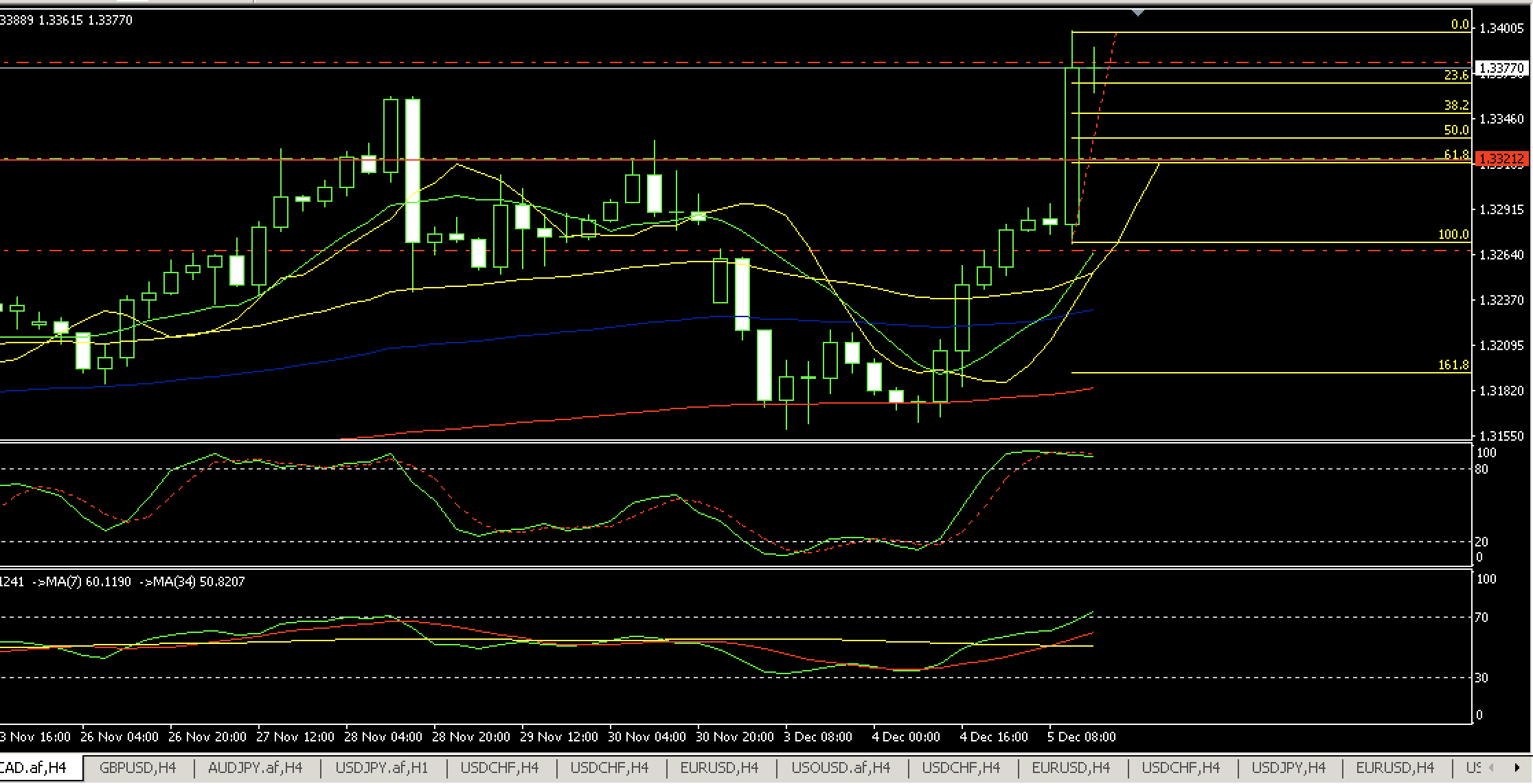

So, not withstanding, the above caveats I favour a USD/CAD long or a CAD/JPY short. Technical places to enter include the 50, 100 and 200 EMA on the 1 hour chart and the Fib retracement levels from yesterday's drop. The USD/CAD 61.8% retracement looks good since it is the horizontal support level and a pivot point too. Stops can be placed below pre-statement release prices and moved up if/when prices reach for the highs again.