PBOC lowers required reserve ratio

The Chinese state media has been hinting at a January RRR cut for weeks, as I highlighted on Monday.

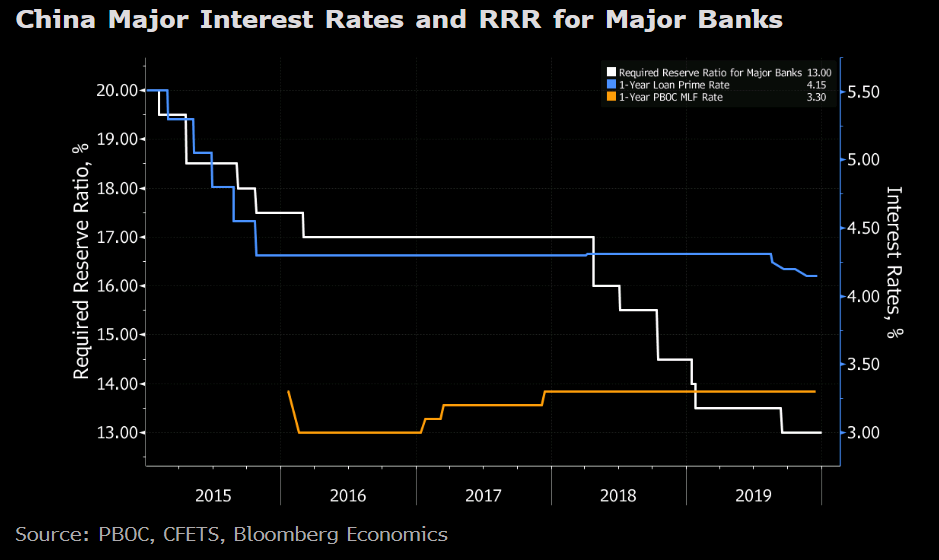

It took only hours into the New Year for the PBOC to deliver. The central bank announced a 50 basis point cut in the required reserve ratio, effective January 6.

The move will unleash about $115 billion in liquidity by lowering reserves to 12.5% for large banks and 10.5% for smaller ones. The aim is to increase lending and lower costs for business.

The PBOC often cuts rates before the holidays late in January and the statement hints at more action. The main policy rate in China is now the Loan Prime Rate and a 20-30 bps cut to just below 4% will likely come before long.

The cut will likely provide a jolt to Chinese markets to start the year and that may spread to the rest of the world.