Data expected to be released at 10 PM ET Sunday/0200 GMT

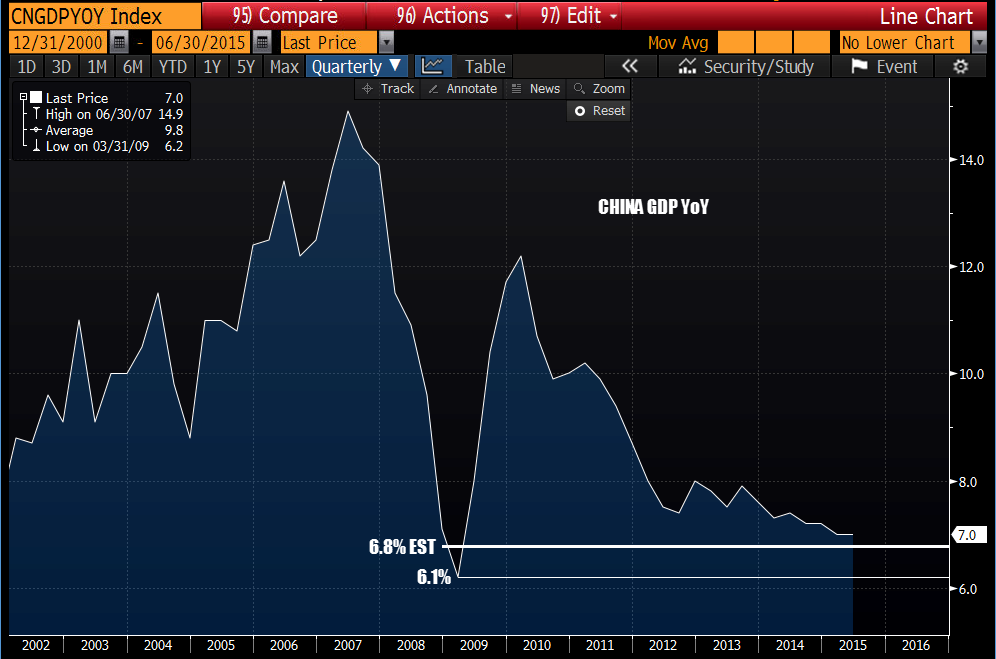

China GDP will be released on Sunday/Monday - depending on where you are in the world (10 PM ET/0200 GMT). The expectations are for a decline to 6.8% YoY/1.8% QoQ. The low estimate is 6.4%. The high estimate is 6.9%.

The lowest GDP growth rate reported from China was 6.1%. That was during the lows of the financial crisis in the 1Q of 2009.

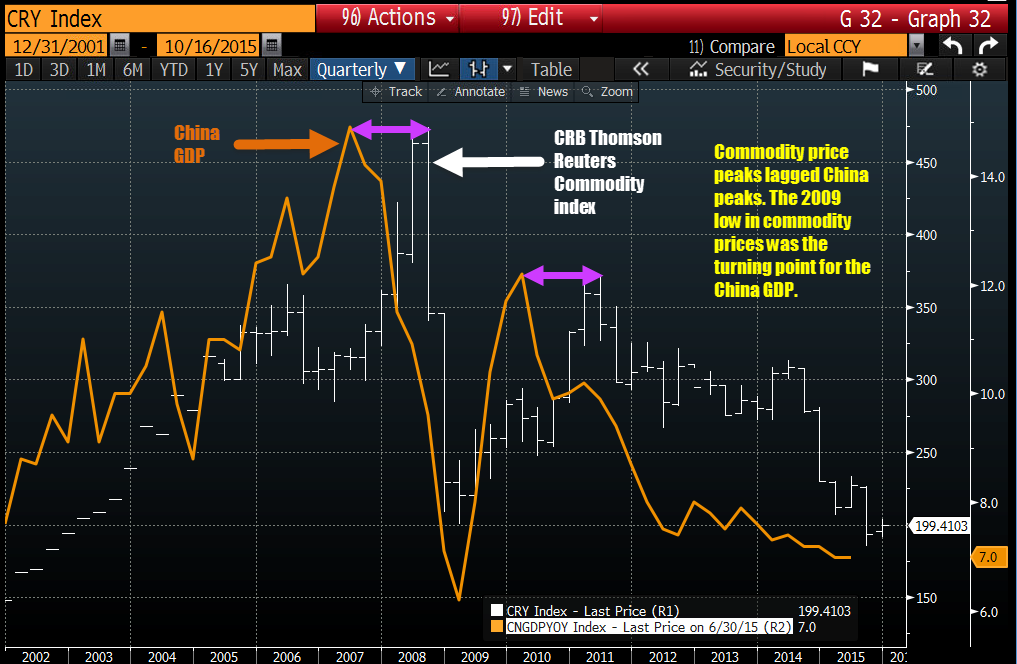

If you recall, the 2008 Olympics started on August 8, 2008 (8/8/08) - right before the start of the tumble in global economy and later (about a year later) in commodity prices. The 2Q of 2007 saw GDP soar by 14.9% and commodity prices as measured by the CRB/Thomson Reuters commodity index peaked a year or so later (see chart below) - in fact right at the time of the Olympics (coincidence? Probably not).

The same pattern was observed when China GDP recovered into 2010, Commodity prices peaked about a year later.

The low in commodity prices in 2009, corresponded exactly with the low in the China GDP.

So recent history suggests that commodity prices and the China economy go hand in hand. It is probably too early to suggest the bottom is indeed in, but we do know that GDP is likely to print a new low going back to 2009 on Sunday/Monday.

How does a commodity currency like the AUDUSD react to changes in China GDP?

Looking at the broad chart below, in 2009 at the lows of China GDP growth, the AUDUSD bottomed at 0.6000. Currently, with GDP expected to come in at 6.8%, the AUDUSD is considerably higher at 0.7278. This may because the AUDUSD continued to rally after China started to slow from its 2010 GDP peak. Perhaps other emerging economies and domestic demand, along with the lag in the economy kept the AUDUSD supported. That delay, has kept the AUDUSD ahead of the sharp decline seen in 2008/2009

Can traders gleam any nuggets of information from the analysis?

Perhaps as demand for commodities increases, so to does the China economy. That also seems to be a turning point for the AUDUSD as well. Nothing really new there, I know. Is there a definitive change in commodities that may suggest growth is around the corner? Commodities are higher this month. So there is a glimmer of hope, but it might be still too soon to call the bottom.

Traders will have risk in the commodity currencies come Sunday evening/Monday. Be aware.