Deutsche Bank Markets Research published a piece on Thursday with a look at the USD.

It's a look at longer-term trends.

In a brief summary of the major points:

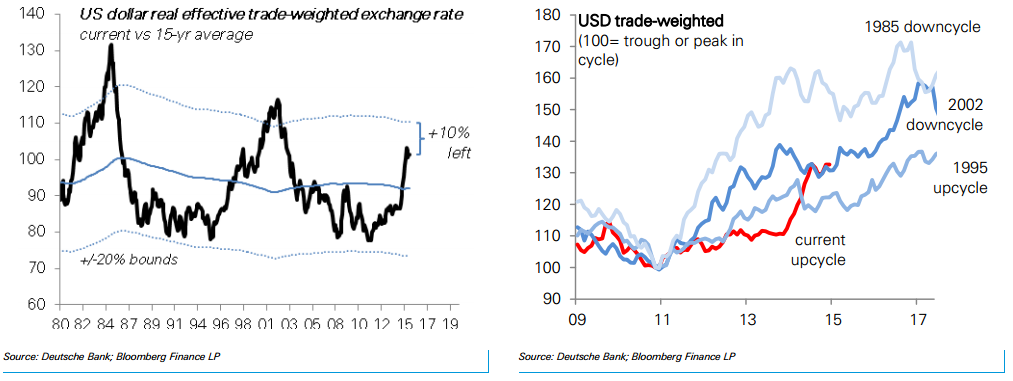

- Say they have a 'committed dollar bullish view'

- Dollar cycle is maturing but there is at least 10% appreciation to the trade-weighted USD to go

- Dollar cycle is turbo-charged, so a deceleration may be due

- Dollar no longer correlated to risk appetite

- World's major funding currency is now the euro

- China's renminbi is the only major currency to have strengthened vs, the dollar since the up cycle began

- USD is becoming expensive, but not across all currencies... most Asian and GBP currencies remain over valued, yen has become cheap

-

Their ranking of the major currencies (I've left out many of the smaller currencies), from most to least expensive:

- GBP

- USD

- NZD

- CHF

- AUD

- CNY

- SGD

- CAD

- EUR

- JPY