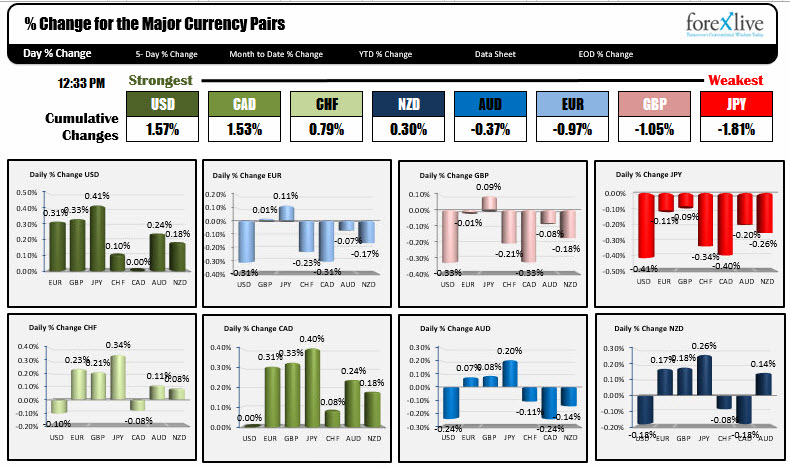

Up against all the major currencies

Fed's Dudley was more hawkish when he spoke at the start of the NY session and that helped to turn the dollar higher.

- Yields on US debt which was unchanged to a little lower, turned higher by 2-3 basis points.

- US stocks moved higher with the Nasdaq up 1.2% and the S&P up 0.70% now.

- Gold fell and is now down -$5.50 from around unchanged levels earlier.

All helped contribute to a better tone in the greenback.

EURUSD: The EURUSD has moved to the 1.11609-71 area and is now trading below that area. For shorts who see more selling, close risk is a move back above 1.1171 now. For a look as the levels, click on recent post here...

USDJPY: The USDJPY is trading near high levels and looks to start to test upside resistance.

- 111.417 is the high from last week

- 111.51 is the 200 bar MA on the 4-hour chart

- 111.576 is the 50% of the move down from the May 11 high

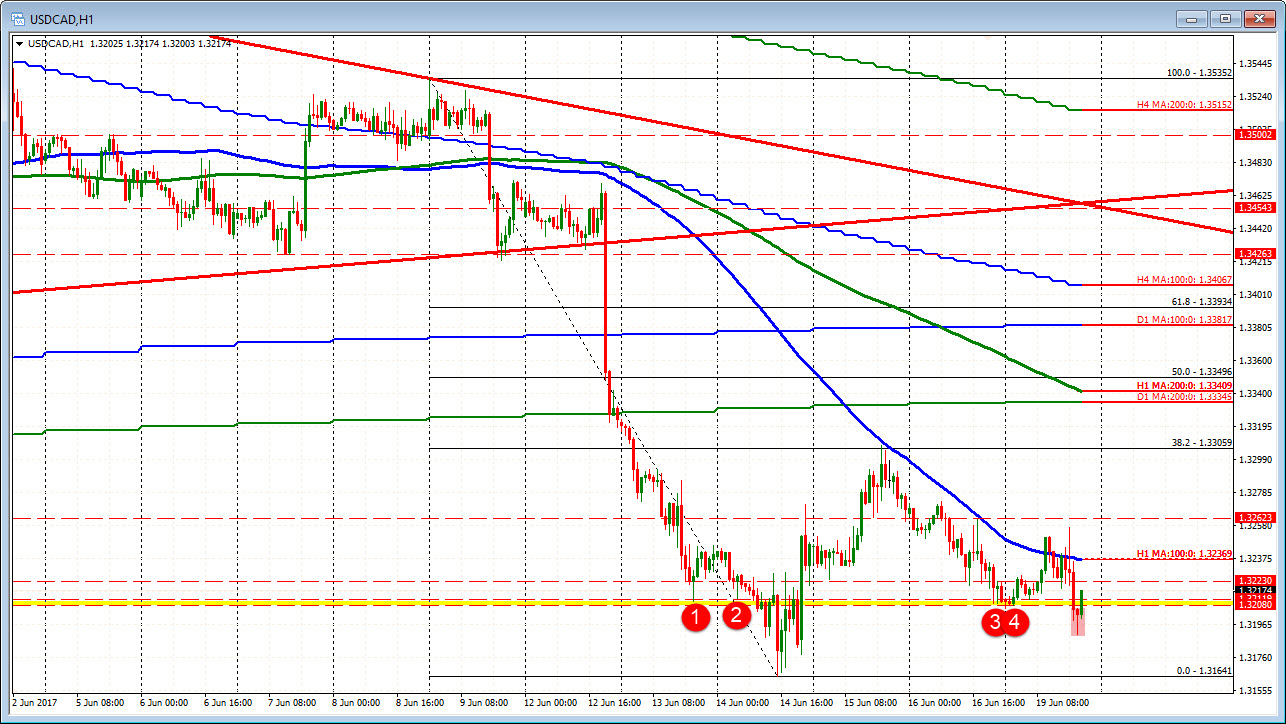

USDCAD: The dollar has not done well against the trending USDCAD. That pair tried to move higher earlier in the day - moving above its 100 hour MA on a couple of occasions. The price did fall below support at 1.3208-11 which is a key area for the pair (see earlier post here). We are back above that that area. Is the USDCAD setting up for a correction higher (again)? It needs to get and stay above the 100 hour MA at 1.3268 now.

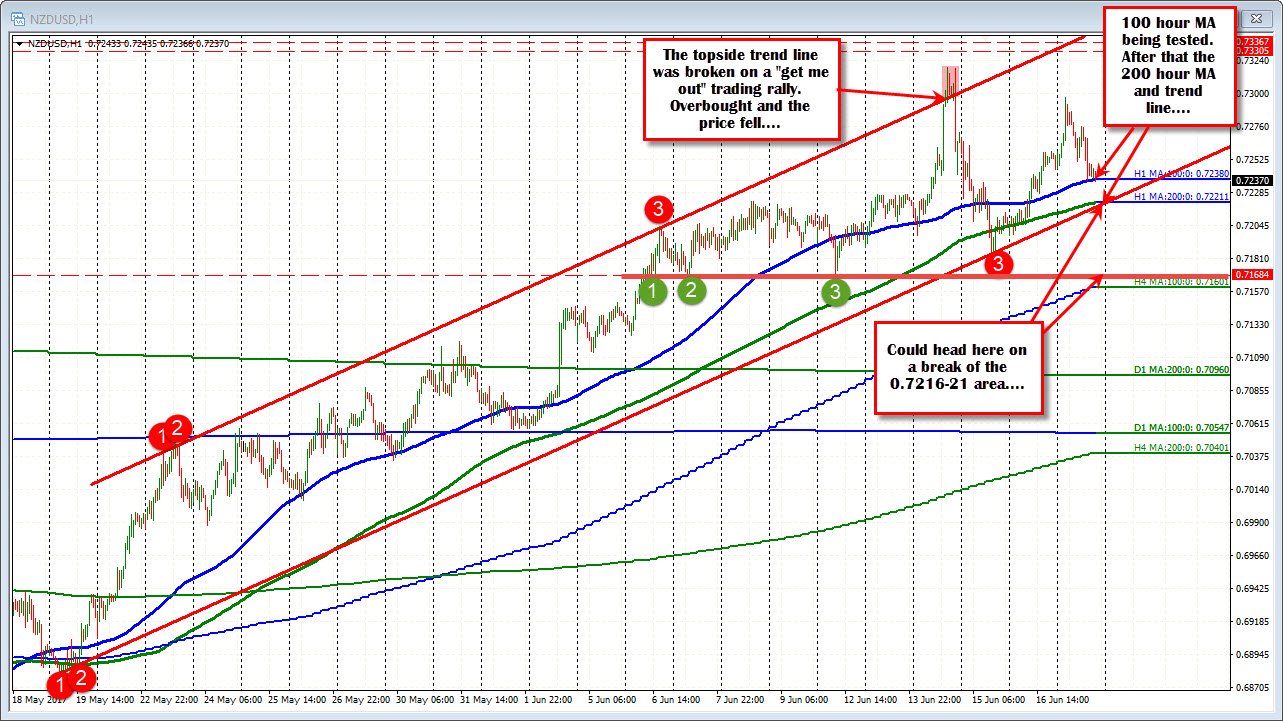

NZDUSD: The NZDUSD tests the lows for the day and the 100 hour MA at 0.7238. A move below is more bearish with the 0.72167-0.7221 the next key target area with the 200 hour MA and trend line at the area (see post).