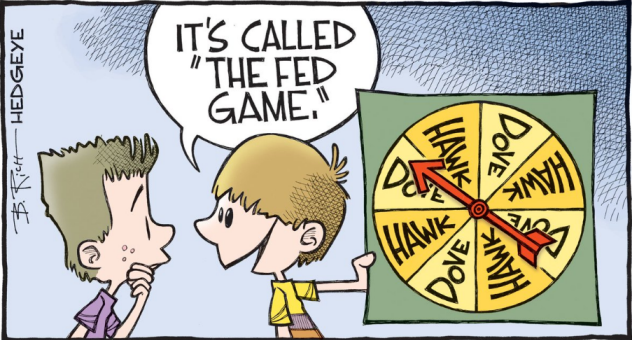

UK inflation data on the agenda but it is all about the Fed today

Major currencies are trending more sideways to start the day with the dollar keeping steadier in trading yesterday as we look towards the FOMC meeting today.

It is likely to be a lackadaisical and a lame session given that market participants will surely rather wait on the Fed before committing to any serious moves later.

US futures are keeping flattish after a slight pullback yesterday but once again, the mood for the rest of the week and at least in the short-term will rest on the Fed.

0600 GMT - UK May CPI figures

0600 GMT - UK May PPI figures

Prior release can be found here. UK inflation is estimated to tick higher once again in May, as the reopening and supply constraints add to base effects in rising year-on-year inflation. That will keep the BOE on their toes in the months ahead.

0700 GMT - China May retail sales data

0700 GMT - China May industrial production data

The scheduled release for the data set above is changed to 0700 GMT and Eamonn laid out the expectations and prior releases earlier here.

1100 GMT - US MBA mortgage applications w.e. 11 June

Weekly US housing data, measures the change in number of applications for mortgages backed by the MBA during the week. Amid the sudden turn higher rates this year, recent mortgage activity has dipped with purchases falling sharply alongside refinancing activity so it'll be one to watch out for.

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.