It will be another day where central bank, government stimulus, and virus headlines will dictate the pace of the trading day

Can central banks and governments across the globe put out the fire?

Another limit down day for US futures as the market continues to sour amid coronavirus developments across the globe. The fact that the US bill is bogged down by politics isn't quite helping with the situation, as fear continues to plague the market.

The hope for central banks is that they can inject enough liquidity to address dollar funding issues and also prevent the unwanted combo of bonds getting routed alongside the equities market. So far, they are barely hanging on but let's see how long this can last.

In the currencies space, the dollar is mildly retracing gains against the euro, pound and yen but is keeping a firm grip on gains against the risk/commodity currencies today.

0900 GMT - SNB total sight deposits w.e. 23 March

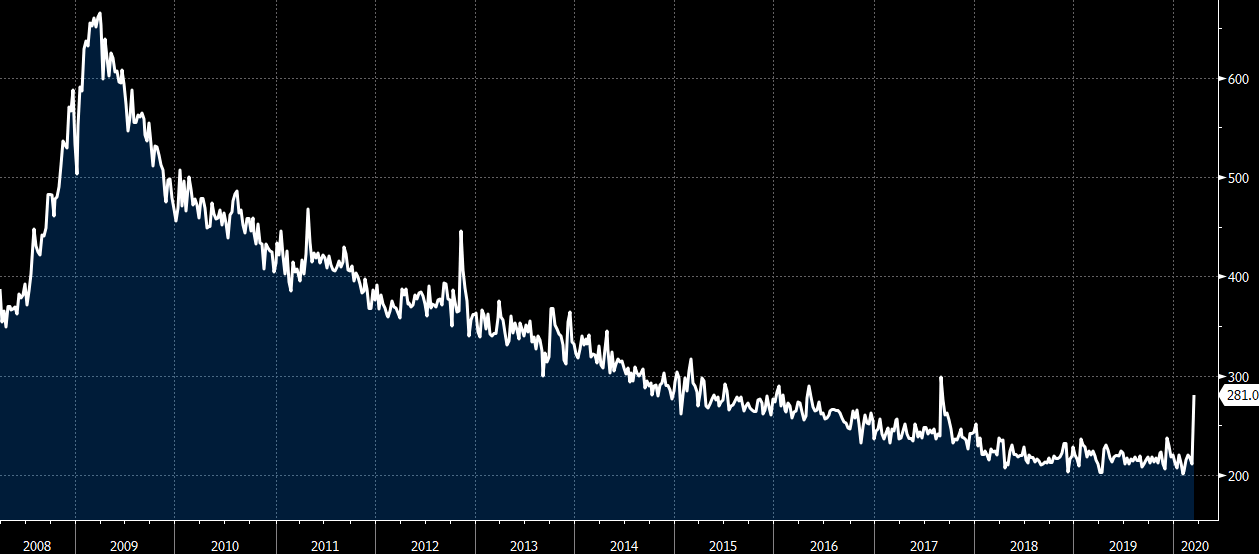

Your weekly check of the deposits kept at the SNB by Swiss banks. This data is a proxy for FX interventions. With the SNB saying they will step up interventions, expect the data release here to be more keenly observed over the next few weeks - for any weak/strong signs of trying to stem the appreciation in the franc.

Economic data releases may not matter all too much today but tomorrow we'll get March PMI data in Europe and that will certainly put things further into perspective.

And on Thursday, we will get US weekly initial jobless claims. Expect that to be a blowout number - possibly above 1 million - that will shock the market.

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.