Economics has been moved to the mathematics department but belongs in philosophy.

In mathematics, equations must be proven – there is a solution, a final answer.

Pie doesn’t change depending on the circle – it’s a calculation that equals 3.1415 etc, a precise if infinite number. Pythagoras Theorem states a2+b2=c2 for any right angled triangle with c as its long side. The formula is at least 2500 years old and as true today as it was then.

Mathematical equations give definitive answers, it’s the same with physics. The most famous equation is Einstein’s E=mc2 but Newton’s laws of motion will do as well: force equals mass times acceleration is absolute. There is a reason the Laws of Gravity are called Laws.

This isn’t often the case with financial theory and economics. We may use equations and dress the subjects up like mathematics, but there are no definite answers in the study of finance and economics. By using the same language as mathematics and physics, we have a false sense of security and put too much confidence in the model-driven results.

Reinhart and Rogoff is the latest example of such excess of faith. Intuitively what they say makes sense – excess state debt will slow a country’s growth rate – but too much reliance was placed on the exact 90% debt to GDP figure initially. And now that has been proven to be in error, the whole of the study is almost disregarded. But my point is that the initial trust in the modelling was too great. This is not an exact science. Economic and financial modelling is an attempt to understand, it does not give precise rules and answers (as any GDP forecast highlights so well).

Value At Risk is a particular bugbear of mine. At its most basic form banks use VAR to give a dollar value of potential losses in a given situation. For example, if a stock market falls 3% in a day (perhaps a two standard deviation move), then the model says the bank will lose $100mn. However what is exceedingly well documented is that financial market returns are not normally distributed and supposedly exceedingly unlikely events – eg market crashes – occur much more frequently than mathematical models predict. In financial jargon, tail risk is under-priced. So banks have developed much more complex models for VAR, which is not necessarily progress. In the case of the JPMorgan Whale, the reliance on a VAR risk model few understood hid massive proprietary trading positions, resulting in more than $6bn in losses. This is a multi-billion dollar example of an excess of faith placed in a financial model that completely failed to predict what occurred.

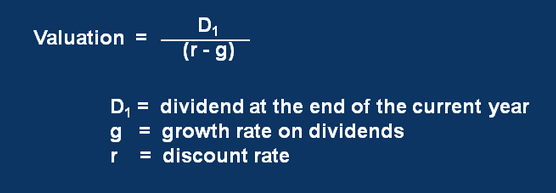

So let’s look at some examples to illustrate the non-precise nature of financial equations. The valuation of shares is a very non exact “science” although that has not stopped many trying. The famous but basic Gordon Growth Model, developed by Gordon and Shapiro in 1956, assumes that the value of a company (V) derives from its future dividends.

No stock ever has consistently been valued on this basis, but that is not the point – it is an attempt to model and understand a key driver of equity valuation. It may look like a definitive maths equation, but it is not. There are equations for currency valuation, interest rate parity, purchasing power parity and even uncovered interest rate parity. They are all simply attempts to understand movements in exchange rates – and they certainly don’t give answers (otherwise there would be much less trading in forex – a sad state for many of you).

The study of economics and particularly finance is still relatively new and academics have advanced comprehension considerably. But avoid too much reliance on models. New research suggests Google searches could provide the Holy Grail of finance – perfect market timing. Searches such as “stocks” and “portfolio” and “economics” are correlated to falls in the stock market as investors’ type in these searches more often when they are fearful. According to the report “a short term trading strategy based on searches for the word “debt” would have returned 326% between 2004 and 2011. But read on to discover that the volume of searches for “colour” and “restaurant” appear to have more predictive value in future market movements than searches for “Dow Jones”. Why would the stock market be correlated to people searching for the word colour? Clearly this is another example of financial relationships and modelling gone too far.

Which nicely brings me to black box or algorithmic fund managers who mine huge amounts of price data to find tiny relationships between asset prices. They then use leverage to maximise the profit from these small and fleeting correlations to make money. My view? More often than not, they work until they don’t, by which time any past profits created can disappear remarkably rapidly.

As an aside, a friend of mine worked at one such fund and said it had an exceedingly weird and unpleasant working environment. There were a number of teams of mathematical geniuses who worked on different parts of the black box model and were not allowed to talk to each other. Only the two founders of the fund knew how the different parts came together and as that was the secret to their multi-billion fund. They kept teams totally separate and the secret safe.

The exception to all this distrust is bond mathematics, where valuation equations do truly predict prices. The genius is in knowing what rates to input.

Mathematics and science deal with facts, truths and universal laws. On the other hand philosophy is the rational investigation of principles, a system of thought based on study and investigation. Remembering that economics and finance belong to the latter category and not the former will avoid costly mistakes. The illusion of supposed mathematical safety is dangerous.