Dax up 1.5%. UK FTSE up 0.6% despite Brexit hurdles

The European major stock indices are ending the day with positive gains. All major indices are higher:

- German DAX is up 1.5%

- France's CAC is up 1.3%

- the UK FTSE is up 0.6% as Brexit negotiations continue

- Spain's Ibex is up 1.5%

- Portugal's PSI 20 is up 0.18%

- Italy's FTSE MIB is up 1.16%

In the European 10 year note market:

- Germany 0.339%, +3.4 basis points

- France 0.649%, +4.2 basis points

- UK 1.288%, +5.5 basis points

- Spain 1.410%, -0.6 basis points

- Italy 1.713%, unchanged

- Portugal 1.898%, +1.6 basis points

- Greece 5.383%, -6.7 basis points

In other markets as London/European traders look to exit:

- Spot gold is down $5.80 or -0.45% at $1274.70

- WTI crude oil futures are down $.62 or -1.06% at $57.72

- US stocks are trading mixed with a rotation into the large-cap Dow stocks and out of the tech heavy NASDAQ stocks. The Dow industrial average is up to 247 points or 1.02%. The S&P index is up 15 points or 0.57%. The NASDAQ composite is down 22 points or -0.32%

- US yields are higher but off the highest levels. Two-year 1.808%, +3.6 basis points. Five-year 2.156%, +4.3 basis points. 10 year 2.391%, +3 basis points. 30 year 2.75%, +2.4 basis points. The benchmark 10 year yield reached a high level of 2.4187% earlier in the session.

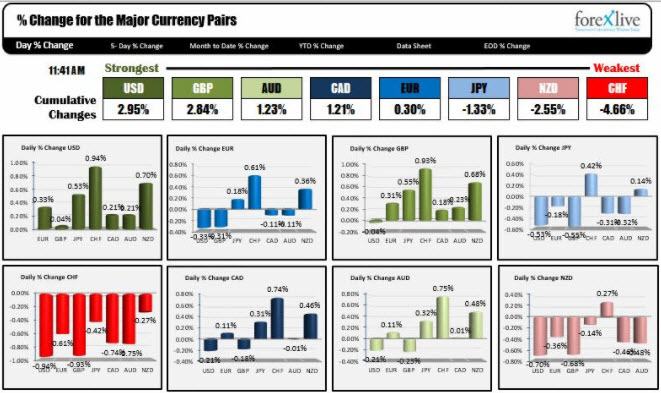

In the forex market, the USD is the strongest currency now. It took over from the GBP from the start of the US session. The failure to come to an agreement on the Brexit negotiations has taken the GBP off higher levels. The CHF remains the strongest currency. The USDCHF is trading at the highest level of the day as I type.