Latest data released by Markit - 21 May 2021

- Prior 50.5

- Manufacturing PMI 62.8 vs 62.5 expected

- Prior 62.9

- Composite PMI 56.9 vs 55.1 expected

- Prior 53.8

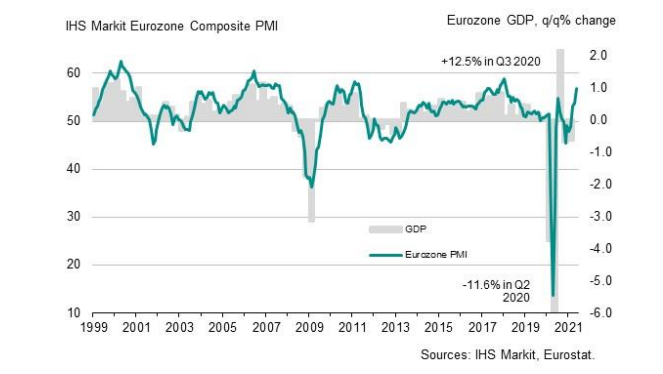

This is an encouraging report as it reaffirms some pickup in services activity in the euro area as economies start to get back on their feet and move on from virus restrictions. The manufacturing sector is stalling a little but is keeping at robust levels overall.

Of note, new order inflows surged to its highest not seen in almost 15 years as business optimism continues to break new highs as sentiment surrounding 2H 2021 looks extremely positive. Markit notes that:

"Demand for goods and services is surging at the sharpest rate for 15 years across the eurozone as the region continues to reopen from covid-related restrictions. Virus containment measures have been eased in May to the lowest since last October, facilitating an especially marked improvement in service sector business activity, which has been accompanied by yet another near-record expansion of manufacturing.

"Growth would have been even stronger had it not been for record supply chain delays and difficulties restarting businesses quickly enough to meet demand, especially in terms of re-hiring. The shortfall of business output relative to demand is running at the highest in the survey's 23-year history.

"This imbalance of supply and demand has put further upward pressure on prices. How long these inflationary pressures persist will depend on how quickly supply comes back into line with demand, but for now the imbalance is deteriorating, resulting in the highest-ever price pressures for goods recorded by the survey and rising prices for services."