Latest data released by Markit - 23 November 2021

- Prior 54.6

- Manufacturing PMI 58.6 vs 57.3 expected

- Prior 58.3

- Composite PMI 55.8 vs 53.2 expected

- Prior 54.2

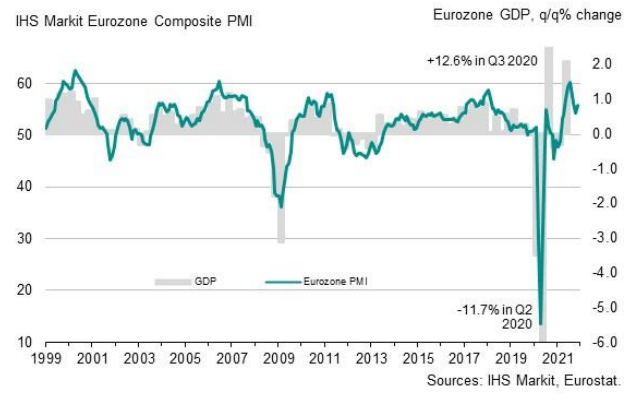

The French and German readings earlier served as a prelude to the beats in the overall Eurozone report here, reaffirming a modest improvement in business activity in both the services and manufacturing sector this month.

However, as mentioned here, it belies the ongoing concerns on the outlook and that is arguably the more important detail to be wary about. Markit notes that:

"A stronger expansion of business activity in November defied economists' expectations of a slowdown, but is unlikely to prevent the eurozone from suffering slower growth in the fourth quarter, especially as rising virus cases look set to cause renewed disruptions to the economy in December.

"The manufacturing sector remains hamstrung by supply delays, restricting production growth to one of the lowest rates seen since the first lockdowns of 2020. The service sector's improved performance may meanwhile prove frustratingly short-lived if new virus fighting restrictions need to be imposed. The travel and recreation sector has already seen growth deteriorate sharply since the summer.

"With supply delays remaining close to record highs and energy prices spiking higher, upward pressure on prices has meanwhile intensified far above anything previously witnessed by the surveys.

"Not surprisingly, given the mix of supply delays, soaring costs and renewed COVID-19 worries, business optimism has sunk to the lowest since January, adding to near-term downside risks for the eurozone economy."