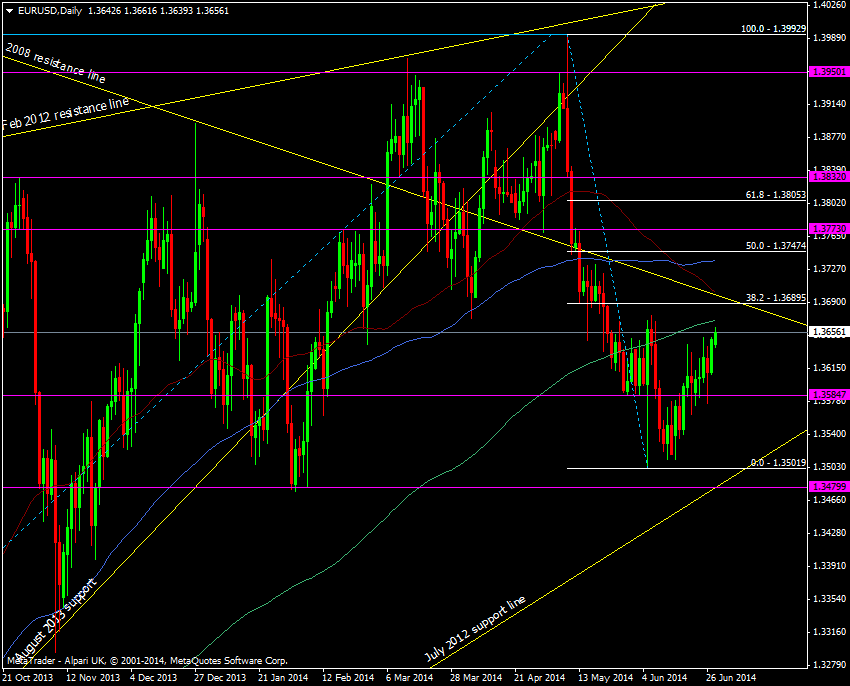

1.3660 and the 200 dma at 1.3669 was on a lot of traders radar as an area to re-enter shorts and at the moment that level is under pressure but holding for now.

The inflation figures were not music to the shorts ears but maybe a little melodious for the bulls.

EUR/USD daily chart 30 06 2014

There may be a few shorts who will cover on a decent break through the 200 dma but I would expect that we won’t see any major moves unless 1.3700 gets smoked. Ahead of that we have the 38.2 fib from the Draghi drop back in May and then the old 2008 resistance line at 1.3698, which is joined by the 55 dma at 1.3701. Above that is the 100 dma and 50, fib at 1.3737/47

The buyers will want to see 1.3650 stoutly defended for fear of a further fall back to support at 1.3640.