EUR/USD climbs to session high as sentiment deteriorates

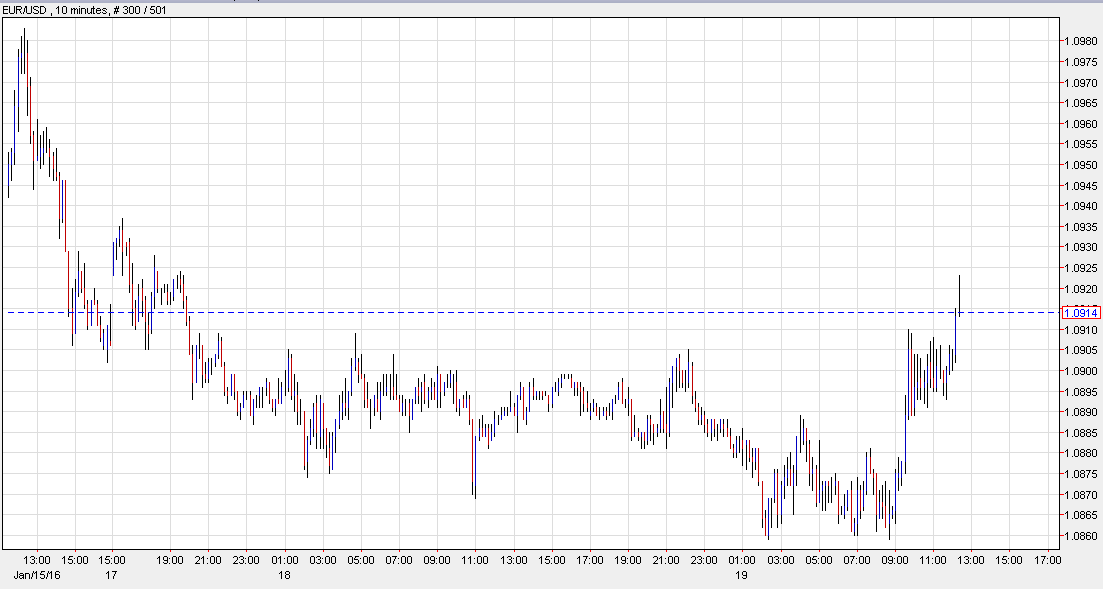

The euro has held a steady bid since US traders arrived and it's extended 1.0922 from a low of 1.0860 early in US trading.

The market knows the ECB is dovish but there is easing in the pipeline and Draghi has remained cautious about deploying more until they get a chance to see how the latest round performs.

The Fed, meanwhile, is relentlessly hawkish.

Three reasons why EUR/USD climbs when stocks fall

The inverse correlation between stocks and EUR/USD changes over time. 1) At the moment, the market is betting that the continued negative conditions make it more likely the Fed backs away from rate hikes than that the ECB delivers something new and substantial.

2) There is also more hot money that's flowed into the United States and it's leaving on economic uncertainty.

3) Finally, the euro is a carry-funding currency and that unwinds on risk aversion.