EURUSD finds 1.0900 as support or resistance above and below

There's some little battles going on at the 1.0900 area. It was resistance towards the end of the US session and early Asia and is now support during Europe. Asia was said to be buying earlier this morning and they've taken the price up through 1.0900 to resistance at 1.0930

EURUSD 15m chart

The levels on the topside are pretty clear intraday and 1.0980 is the final level to watch before we get a test of 1.1000

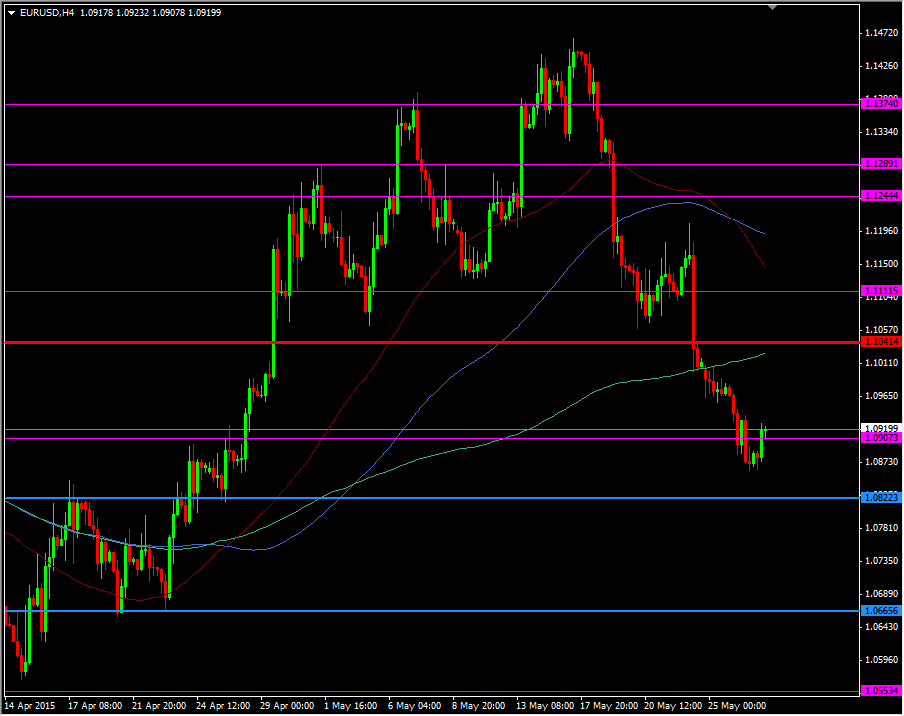

Further out the 200 H4 ma has played support and resistance in the recent moves and the old range top at 1.1040 has held a test following the break through

EURUSD H4 chart

1.0950 looks the choice level for intraday shorts with a break of 1.0980 a stop point. A stop could be pushed to a break of 1.1000 if your pockets stretch that far. The 200 H4 ma and the 1.1040/50 level look prime for a longer term short, while a break and confirm above there brings the upside into play once again

Support is found intraday at 1.0900, 1.0890, 1.0870 and then against the lows from yesterday around 1.0860/65

The calendar is light today, and virtually non-existent in the US, so inspiration will have to come from elsewhere. It's worth keeping an eye on European yields for signs of ECB activity if they continue their summer front run on QE buying

Update: Now hearing of corporate buyers doing some month end buying while stops are said to be building above 1.0960