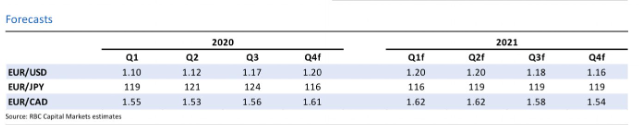

The 1 to 3 month view on euro via RBC.

- EUR strength associated with the agreement of the European Recovery Fund in the summer

- Having fully digested the fiscal stimulus this implies, however, the impact on relative growth expectations is disappointing.

- Looked at cumulatively though 2020 and 2021, Eurozone consensus growth forecasts have not risen at all

- In contrast ... in the US, economists are consistently revising US growth expectations higher

- Unless this changes, we see EUR getting little in the way of support from cyclical factors in the near-term.

- Recent EUR gains were mentioned in the opening remarks of the September 10 ECB meeting press conference -something that has happened only rarely in the past. This was followed by numerous comments on the damaging effects of currency strength from various Governing Council members With EUR undervalued on almost all measures of competitive equilibrium, it was likely the pace of its appreciation that that was cause for concern, rather than the outright level.

- We maintain a slight positive bias on EUR/USD, driven largely by hedging flow ... rather than policy or growth expectations

- but expect gains to be capped by the recent high around 1.20. sks and natural real money buyers of EUR emerging, we retain a slightly positive bias.