Latest via ,National Australia Bank, this in brief:

NAB forecast AUD to 0.70 in September and 0.72 by December

- even if we see a further deterioration in Australian-China relations resulting in further specific actions against Australian exports to China, it's doubtful this will suffice to see the lower end of the range broken, unless the likes of future iron ore, education and/or tourism exports come firmly into China's firing line.

This is a good heads up on what to keep an eye on re Aus/China relations.

For now:

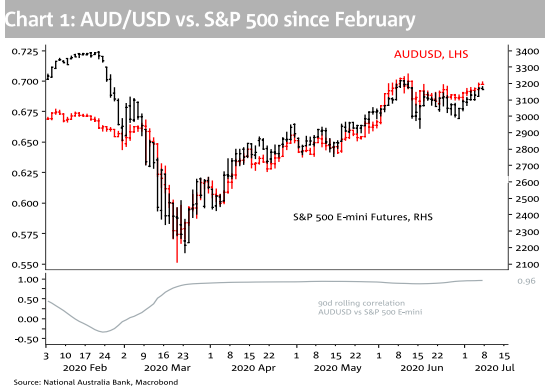

- current fixation with swings in risk sentiment as the main driver of AUD volatility:

More:

- important to keep in mind that ultimately, more important than risk sentiment, swings in commodity prices (terms of trade) and (real) yield differentials will drive the AUD's fortunes over the long run

- a sustained move above 0.70 in H2 2020 and subsequently, as per our forecasts, requires support from improvements in the terms of trade and/or a further widening in real bond yield differentials in favour of AUD. We are currently more confident on the former than the latter