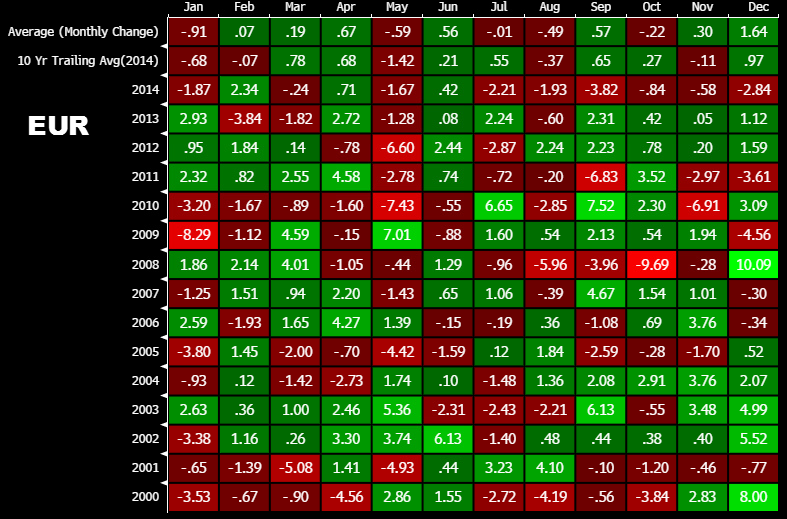

The seasonal pattern for the euro in December

December is the best month on the calendar for the euro since 2000. It's gained an average of 1.64%. In the past 10 years that performance has diminished to +0.97% but it's still the top month over that period by a healthy margin.

The huge risk to euro longs in December is the ECB decision on Thursday. Draghi is expected to expand the QE program and lower the deposit rate (more on what's expected from the ECB).

If the ECB surprises markets with a more aggressive program, then look for heavy euro selling towards parity with the US dollar.

Last December, the ECB began to drop hints about a QE program in December and it was delivered a month later. That led to the 2.8% drop in the month.

The bull case

It's a daring move to buy the euro ahead of the ECB in the hopes that the seasonal pattern will continue. The main reasoning would be expectations that Draghi disappoints with a smaller program. In addition, positions are heavily tilted towards EUR shorts and their could be a squeeze, especially with books squaring up into year end.

I'll have more forex seasonals tomorrow.