Monday consolidation. Tuesday and Wednesday surge. Thursday and Friday plunge

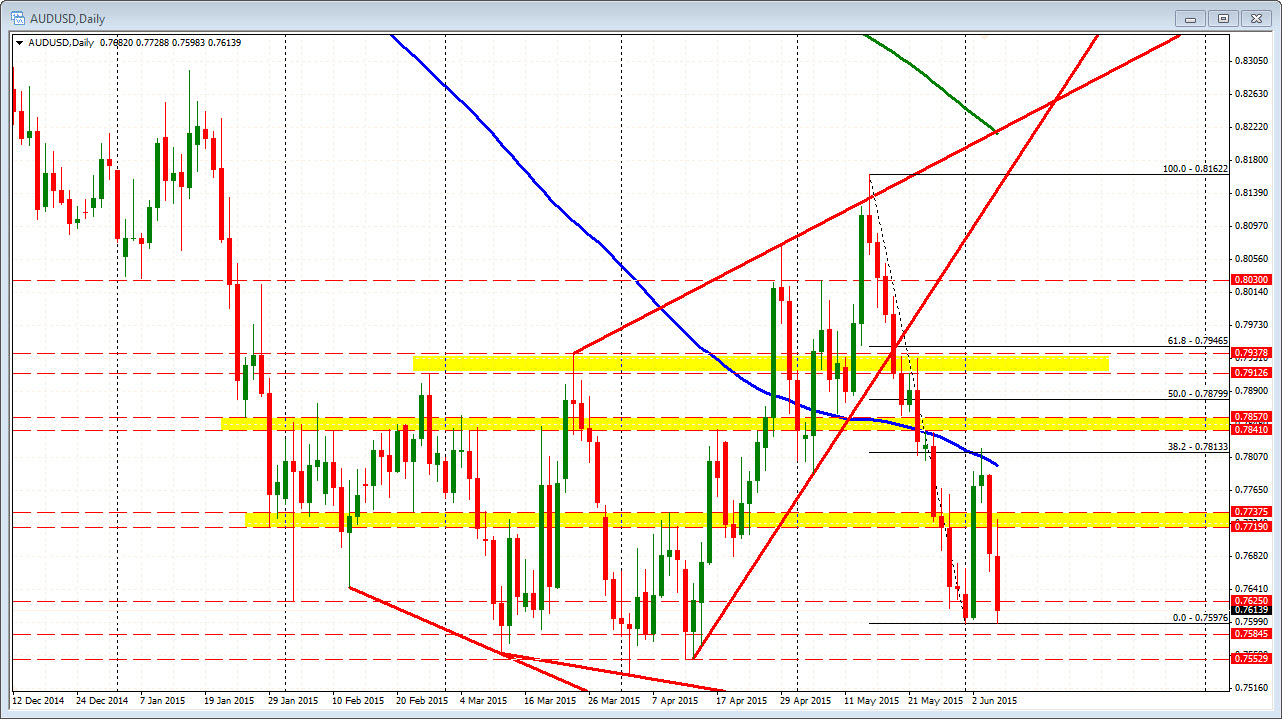

The AUDUSD has completed a lap in trading this week. Monday was a consolidation day - testing the low close for the year at the 0.7984 (low reached 0.7597). Tuesday and Wednesday saw the pair surge to test the 38.2% retracement of the move down from the May 2015 high at the 0.7813. The 100 day MA was also tested (blue line in the chart below). Since, then the price has tumbled back lower with Thursday helped by poor economic data out of Australia and today the USD dollars turn after the much stronger-than-expected US nonfarm payroll report. The low today came in at 0.7598. This was pretty much the low Monday (0.7597). VROOM...VROOM Go speed racer go.

The low close for the year is at 0.7584 and a move below that level will be eyed as the next downside target for the pair. Below that there are 9 other lows that extend down to the year low at 0.7532. Remember a few months back (maybe more than a few), Gov. Stevens of the RBA said the equilibrium level for the AUDUSD was at 0.7500. We are once again getting close to his target.

Watch the 0.7625-34 as close resistance intraday (see chart below). This is the 38.2-50% from the post NFP corrective high. A move above this area might muddy the waters especially after the double bottom. Could see more two-way price action. The other currencies are correcting now as well with the EURUSD back above the 100 day MA and the GBPUSD bouncing off the 50% retracement level (see prior technical reports.).