February announcement took a few days to digest before EURUSD fell

Back in February, the bailout extension was agreed for 4 months which has brought us to this point. At that time, the activity prior to the announcement was choppy as markets reacted to on again/off again comments. Below is a hourly chart from that period. If you recall, the deal was announced on a Friday. The Greeks were supposed to submit a list of proposals on Monday. They delayed that until Tuesday and reluctantly they were accepted. Mario Draghi termed it a "valid starting point". Christine Lagarde said the Greek reforms were "generally not very specific".

Four months later and the devil is in the details once again. I remember Adam commenting back in February how much time is spent on Greece and that trend continues.

Back in February it took a few days for the market to cast its vote of Yeah or Nay, but the month of February ended on a bearish note. On Thursday Feb 26th the EURUSD tumbled from 1.1350 to 1.1180 and by March 13, the low of 1.0461 was reached. This is how I summarized the month back in February.

Today, we get another agreement. The comments from the WSJ say "Eurozone governments and the IMF have agreed to press Greece for far-reaching economic overhauls, while the IMF has softened its insistence that Europe offer explicit commitments to relieve some of Greece's debt burden". The economic overhauls include "tough reforms of Greece's pension system, labor laws and other areas, as well as creditors' insistence on painful budget measures to ensure that Greece runs a fiscal surplus before interest." The measure will have to be approved in Greece which may be another story.

So what about today?

Well, the political hurdles remain of course but the market has rallied on the relief that something is imminent. Can it ever be specific? Can there be the pension reforms and budget measures. HMMMM. This stuff is not new.

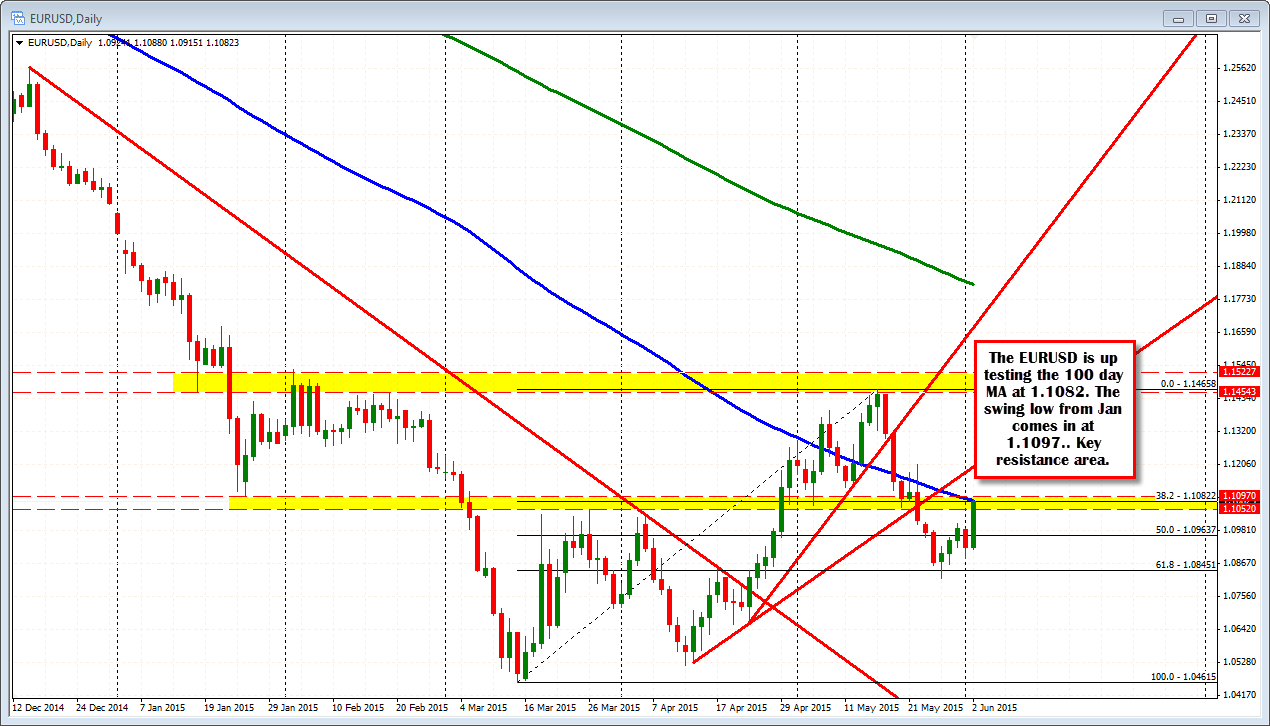

In any case, the EURUSD has rallied today on the headlines and is currently testing the 100 day MA which comes in at the 1.1082 level. The pair has moved through the highs from March at 1.1052. This is now a level to get back below if the bears are to take back control. The swing low from Jan comes in at 1.1097. This area between 1.1082 and 1.1097 should be a tough resistance area.

PS the aforementioned resistance area is being broken and stops are being triggered. the next target does come against the 50% of the move down from the May 15 high to the May 27 low. That level comes in at the 1.1142 level. With the price now above the 100 day MA at the 1.10827 level, that level will now be the eyed as support. Shorts continue to scramble. Buyers are in control.