Forex news for US trading on Nov 18, 2015:

- FOMC Minutes: Officials were "leaving options open" for Dec meeting

- Three things we learned from the FOMC Minutes

- Full text of the FOMC Meeting Minutes from October 2015

- Fed's Kaplan: Gradual hikes means Fed will reassess after each hike

- Fed's Kaplan says he doesn't want to wait for wage pressures before reacting

- Barclays gets $150 million fine for rejecting unprofitable forex orders

- Don't ask the Fed's Denis Lockhart for a Dec rate prediction

- The US economy can handle a 25bp rise says Fed's Mester

- Fed's Dudley: When liftoff happens it won't be a big surprise

- October 2015 US housing starts 1.060m vs 1.160m exp

- Fed's Lacker says the improvement in the labour market has been substantial

- Abe says some in Japan have a "misunderstanding" of the TPP agreement

- Gold flat at $1070

- WTI crude flat at $40.69

- S&P 500 up 33 points to 2084

- US 10-year yields up 1 bps to 2.27%

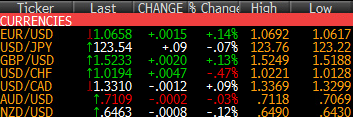

- GBP leads, CHF lags

It was a two-part trading day. The first part was excitement about the possibility the Fed would be hawkish in the FOMC minutes. The second part was disappointment that they didn't offer anything new. The result was a 30-40 pip roundtrip in the US dollar.

EUR/UD slumped early and hit 1.0620 from 1.0660, marking a fresh cycle low. Some shorts were pared into the FOMC minutes and then a run on stops on the release hit 1.0617 but it only lasted a second and then it was higher to 1.0660. There was some choppy, indecisive trading after the Fed minutes but it resolved higher, finishing at 1.0658.

USD/JPY was in a slow march higher on better risk sentiment but offers in the 123.50-60 range capped the early upside. Those eventually gave way but it was shortlived as the pair fell back ahead of the Fed. The minutes caused a jump to 123.70 then a drop to 123.32 but eventually it was back to the middle of the range at 123.54.

Cable was stubbornly strong even in the periods of USD strength. It was the only currency not to fall to a session low against the US dollar in the whipsaw on the Fed minutes. Bids at 1.5180 held and there was a slow march to 1.5231 at the end of the day. The European high of 1.5248 holds for now.

USD/CAD hit 1.3365 as oil fell below $40 for the first time in months but oil couldn't be held down and bounced back to $40.68. Broader USD selling added to the reversal and USD/CAD finishes at the low of US trading at 1.3307.

AUD/USD was one of the first currencies to crack against the US dollar ahead of the Fed minutes as it fell to 0.7075 from 0.7100 but it climbed all the way back and a bit more by day's end, highlighting the broad U-turn.

The Swissy got some attention as USD/CHF recouped the entirety of the SNB move. It's been a long road but provides some justification for the SNB's bellyaching about a strong currency. It's also an endorsement for negative rates, which will be the next front in the global FX war.