Forex news for US trading on Sept 2, 2015:

- August ADP employment report +190K vs +200K expected

- The Fed's Beige Book: Most districts reported modest to moderate growth

- July US factory orders +0.4% vs +0.9% expected

- St Louis Fed director of research - "If you're not ready to raise rates now, when are you going to raise?"

- US Q2 final nonfarm productivity +3.3% vs +2.8% expected

- August ISM New York 51.1 vs 68.8 prior

- Bill Gross: Fed intent on hiking rates but austerity the real problem

- Obama finds enough support to uphold Iran sanctions deal

- EIA crude oil inventories +4667K vs +444K 'expected'

- OPEC Aug oil output falls 170K barrels per day - RTRS survey

- Gallup US job creation index remains at record high

- McCrann: Australian dollar falling no reason to cut rates

- WTI crude up 87-cents to $46.27

- Gold down $6 to $1134

- S&P 500 up 35 points to 1949

- US 10-year yields up 3.5 bps to 2.19%

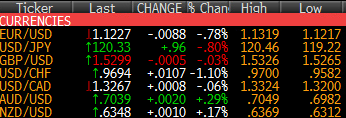

- AUD leads, CHF lags

Choppy markets were the theme of the day. Upbeat risk sentiment was the driver heading into the start of US trading but it stumbled then recovered with stocks closing at the highs. Oil chartered its own course and was equally volatile.

The euro followed the risk trade as it stumbled below the European low of 1.1243 then down to 1.1220 where it consolidated back up to 1.1250 before finishing near the session low at 1.1217.

USD/JPY shot higher in Asia to 120.47 but then fell to 119.72 in US trading. Better risk appetite pushed the pair back close to the Asian high but it hasn't been able to clear the Asian high. Offers at 120.50 capping so far.

The pound finished with a small loss to extend its losing streak to seven consecutive sessions. The low of the day came just after US traders arrived and it tracked steadily upward to a session high of 1.5324 from there but slid back to 1.5300 late.

It was a story we've heard before in USD/CAD. When oil slumped, the pair surged to new highs and when oil rallied, the bounce was shallow. The rise above 1.3300 neared the cycle high but a later rally in oil pared the gains back to almost unchanged at 1.3264.

AUD/USD broke 0.7000 in Asia and Europe but finally founds some bids from there in a rally to as high as 0.7049 but offers at 0.7050 have been tested twice and haven't given way.

For the day ahead, make sure to check out this ECB preview.