Forex headlines for October 10, 2014:

- Canadian Sept employment +74.1K vs +20K expected

- Finland loses its AAA-rating from S&P

- Draghi: Current weakening in momentum may postpone somewhat more resumption in private investment

- Nowotny: ECB expects a depreciation of the euro against the dollar

- S&P lowers outlook on France to negative from stable

- ECB’s Praet says eurozone economy has lost momentum

- Fed’s Fisher: All told, our economy is on the mend

- George: When Fed moves rates back to normal, it should be gradual

- Canadian business optimism rose in Q3 – BOC survey

- Winter to support oil prices says OPEC

- EBA will publish stress test results 10 am gmt Sunday October 26th

- UK’s Osborne says euro area outlook poses the biggest risk to the UK

- Fed’s Plosser: Policy should be data-dependent, not date dependent

- September 2014 US import prices -0.5% vs -0.7% exp m/m

- EU’s Dijsselbloem say the eurozone must get its act together.

- Poloz says Bank of Canada intends generally to abandon guidance on the direction of interest rates

- Deflation fears washing over Europe – Ambrose Evans-Pritchard

- IMF’s Lagarde says the World economy is stuck in a painful jobs crisis

- S&P 500 down 22 points to 1906

- Gold down $1 to $1223

- WTI crude down 18-cents to $89.87

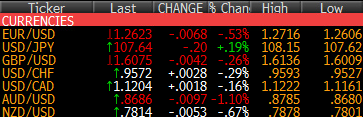

- JPY leads, AUD lags

With a dreamteam of Fed hawks on the speaking docket today, some dollar strength might have been expected but the dollar wasn’t particularly buoyant. Instead it was a wave of risk aversion that ripped through stocks and underpinned a bid in the yen.

Instead, the story was another rout on stock markets with the Dow erasing its ytd gains. The FX market was a bit more stable and 10-year yields fell just 3 bps to 2.28%.

I wondered aloud whether the Canadian dollar could rally at all if it couldn’t rally on the jobs report and that foreshadowed a total retracement. USD/CAD finished at 1.1213, near the highs of the day.

The FX theme was commodity currency weakness and yen strength, which isn’t surprising. All told, the US dollar index finally broke its 12-week winning streak but the bottom came Wednesday and it was a quick bounce.

Here is the rundown for Friday.