Forex news for Asia trading Wednesday 1 July 2020

- Japan's Suga again - coronavirus spread could see state of emergency reimposed

- Japan chief cabinet secretary Suga says the economy is beginning to bottom out

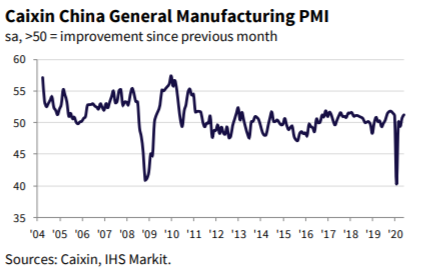

- China - Caixin/Markit Manufacturing PMI for June: 51.2 (expected 50.5)

- Australia Building Approvals for May -16.4% m/m (expected -7.8%)

- Coronavirus - Another border closure in Australia

- US coronavirus cases rose more than 46,000 on Tuesday

- PBOC sets USD/ CNY reference rate for today at 7.0710 (vs. yesterday at 7.0795)

- FX option expiries for Wednesday July 01 at the 10am NY cut

- ANZ see scope for tactical downside for the AUD this month

- Japan - Jibun Bank/Markit Manufacturing PMI (final) for June: 40.1 (vs. May was 37.8)

- BOJ official comments on the latest data, finds a bright spot in supermarket sales

- South Korea begins using remdesivir for COVID-19 treatment

- South Korean June exports -10.9% y/y

- Australia CoreLogic house prices for June: -0.8% m/m (prior -0.5%)

- Bank of Japan quarterly Tankan report - further falls

- Hong Kong markets are closed today

- US coronavirus cases rose by over 40,000 for a 5th time in past 6 days

- UK data - BRC Shop Price Index y/y for June: -1.6% y/y (prior -2.4%)

- Australia - CBA/Markit Manufacturing PMI for June (final): 51.2 (vs. preliminary 49.8 & prior 44.0)

- BOJ dep gov says focus must shift to solvency problems that may arise due to coronavirus

- New Zealand Building Permits for May: +35.6% m/m (prior -6.5%)

- Australia - AiG Manufacturing PMI for June: 51.5 (prior 41.6)

- Australia - shopping centre visits are at 86% of the level at the same time last year

- The PBOC will reduce funding costs for smaller firms and rural sectors from today

- ICYMI - Airbus to fire another 14,000 staff

- Coronavirus - US FDA head says another 6 vaccines in the pipeline for clinical trials

- US coronavirus - Texas records another record for new daily cases, death rate up also

- Canada - Toronto will make mask wearing mandatory indoors

- Coronavirus - More on Goldman Sachs and a mask mandate instead of lock downs

- Trade ideas thread - Wednesday 1 July 2020

- Private oil survey data shows a larger than expected draw in crude oil inventory

China's Caixin PMI for May came in at 51,2, well above the consensus market expectation of 50.5 and April's reading of 50.7. Other Asian Markit PMIs were similarly more promising. These indications of rebound in the region's manufacturing sentiment are encouraging but there is a ways to go. The situation unfolding in the UIS with reimposition of shut downs is going to weigh on global demand and thus Asian producers.

Japan's PMI showed improvement also, but the quarterly Tankan report from the Bank of Japan was a disappointment, marking another consecutive decline in many of the measures.

USD/JPY has been a mover on the session, with no obvious catalyst from news nor data - if anything the continuing run of less than stellar data should argue for a weaker yen as aggressive BOJ easing will go on and on. But, after a move to highs just over 108.15, USD/JPY dropped nearly half a big figure as sellers emerged and the buying interest evident during the US session dried up somewhat.

Currencies elsewhere managed to add small gains against the USD, but ranges were small. Again, while there was plenty of data and news none if it provides an obvious catalyst for the moves. Perhaps it was the improved PMIs but that is pretty thin.

Oil prices posted gains, the initial pop higher was triggered by the private survey of oil inventory showing a substantially larger draw in headline stocks than the consensus expected. Oil prices held their gains nut are off session highs a little. Gold tracked more or less sideways.

China Caixin manufacturing PMI: