Forex news for Asia trading Friday 10 July 2020

- China state funds reportedly selling stocks

- ICYMI (been living under a rock?) - WHO say coronavirus might be spread in the air

- Japan has lined up 10 countries to talk to about easing travel restrictions

- New virus lockdown is going to be a body-slam to whole of Australia economic growth

- Two big data releases due from Australia next week - business confidence, jobs

- Keep an eye on oil prices - the slide reflecting surging coronavirus case numbers

- PBOC sets USD/ CNY reference rate for today at 6.9943 (vs. yesterday at 7.0085)

- FX option expiries for Friday July 10 at the 10am NY cut

- Goldman Sachs say additional measures will be needed to cope with the coronavirus outbreaks in the US

- More detail on the UK out of the EU coronavirus vaccine programme

- Japan PPI for June +0.6% m/m ( expected +0.3%)

- Japan and Australia are planning to resume (limited) travel between the two countries

- Brexit - UK retail industry warns of higher prices if no UK-EU trade deal reached

- Gold is going to $1,900 by the end of 2020 - "central bank policy is a strong driver"

- New Zealand card spending for June: Retail +16.3% m/m (expected +15.0% )

- No sign of the HKMA changing its HKD policy of pegged to the USD

- New Zealand budget deficit is small than forecast

- Keep on watching 0.70 in AUD/USD - will continue to struggle there

- North Korea says a summit meeting this year with Trump is unlikely

- NZD forecasts as "expect the RBNZ to eventually double their QE program"

- UK turns down EU coronavirus vaccine scheme

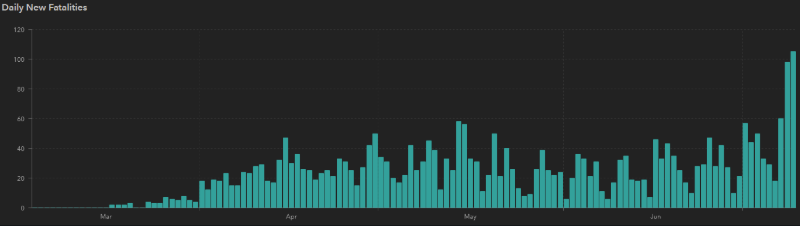

- Coronavirus deaths in Texas hit a record high for the 3rd day running, 105 added to toll today

- US coronavirus - New York has banned large events through until October

- Trade ideas thread - Friday 10 July 2020

Singapore markets were closed today which thinned out Asia trade somewhat but did not lead to much in the way of volatility.

Overnight weakness across equity and FX risk persisted in the session here with a bid for the USD carrying through during Asia morning trade. Stock in China also slid, in addition to the follow-though from US trade local (state pension fund) selling of large cap China stocks weighed.

News and data flow was light. We had the usual dreadful coronavirus figures out of the US, cases, hospitalisations, deaths all higher; hospitals continuing to be pressured due to capacity limits being approached.

It was a third day of record fatalities in Texas at 105: