Forex news for Asia trading Wednesday 11 December 2019

- WSJ says US President Trump has not yet decided on December 15 China tariffs

- China will do whatever it takes to boost economic growth into 2021 - here's why

- BNZ note "softness returns" to the NZ jobs market

- M5.7 earthquake in southern Greece

- S&P says New Zealand's sovereign rating can absorb higher spending

- Three men charged over $722 million cryptocurrency fraud - a “high-tech Ponzi scheme”

- Asian Development Bank (ADB) cuts its growth forecast for China

- Moody's says sovereign credit quality in Australia, New Zealand, and Japan will remain strong in 2020

- PBOC sets USD/ CNY reference rate for today at 7.0385 (vs. yesterday at 7.0400)

- RBC project an RBA rate cut and QE package

- Trump adviser Navarro says he has no indication the December tariffs will not be put on

- The RBA next meet on February 4 (in January they are at the beach) - they'll cut again

- NZD rises on NZ government announcing more infrastructure spending

- NZ will boost fiscal spending (cuts budget surplus forecast)

- Japan data - PPI for November +0.2% vs expected +0.1%

- More on plummeting Australian consumer confidence

- Japan govmt minister says WTO dispute settlement system is a central pillar of free trade

- Australia Westpac Consumer Confidence Index for December: -1.9% m/m (prior +4.5%)

- TD on GBP - "downside risks are rising relative to upside potential"

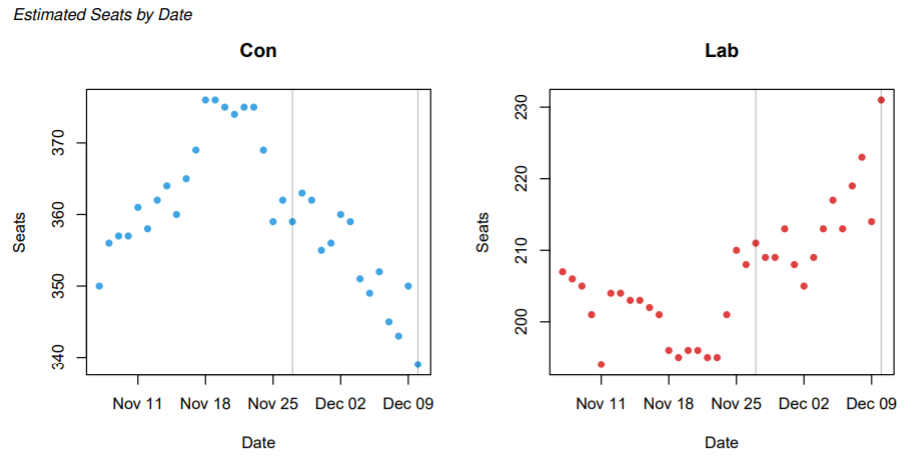

- UK election - How the press is reporting the falling expected Boris majority

- UK election - Here is why GBP traders are freaking out about a possible hung parliament

- GBP has dropped on the latest UK election poll showing Conservative majority shrinking

- YouGov poll says UK election expected 28 seat majority for Johnson

- UK election - YouGov poll to show Johnson majority expected at 30

- New Zealand card spending for November, Retail +2.6% m/m (vs. expected +0.5%)

- Trade ideas thread - Wednesday 11 December 2019

- Oil - private survey of inventories shows a surprise build in headline crude stocks

- Here's a UK election poll showing Johnson to win a 24 seat majority

GBP was a mover upon the release of the latest YouGov UK election poll which showed the forecast majority for the Conservative Party dropping under 30 seats and the 'margin of error' in the poll flagging that a hung parliament is a possibility.

The market had a base case (still do) of a majority government for Johnson, which would create some certainty on Brexit and banish the deadlock. The poll, however, has cause a wobble in this expectation. The election is on Thursday (UK time) and the trend for Johnson has not been positive:

At this rate a banana duct-taped to the wall might be the new PM? I jest. Someone ate it, so no.

GBP/USD dropped heavily on the poll result, losing around a big figure from its highs before stabilising somewhat and retracing a little for the balance of the session here as I update.

NZD was also a mover on the session. News that the NZ government had, in its half-year finances update, pledged to spend some of the projected surplus on infrastructure investment. Added government spending is projected at NZD12bn, which will take some of the stimulus pressure off the Reserve Bank of New Zealand. NZD/USD ticked higher on the announcement but subsequently fell back to hit a fresh session low and its not far from this as I update. Some jobs data from NZ (see bullets above) was on the weak side which may have prompted the AUD/NZD buying that weighed on NZD/USD.

Other currencies moved in mild ranges only with little net change on the day. Gold, ditto.