Forex news for Asia trading Wednesday 15 April 2020

- China says virus outbreak will not impact nuclear power plant construction

- Analyst who picked the US stock market low in March targets S&P above 3000 by year end

- Head of Nissan parts supplier Yorozu says lack of demand is a bigger challenge than supply chain disruption

- Coronavirus - NZ finmin Robertson says the country is examining further support for firms and households

- People's Bank of China conduct 1 year MLF operation

- Coronavirus - Another G7 conference call coming up this week - Thursday

- PBOC sets USD/ CNY reference rate for today at 7.0402 (vs. yesterday at 7.0406)

- FX option expiries for Wednesday April 15 at the 10am NY cut

- US coronavirus economic relief checks to be delayed for several days

- China excavator producers reported record sales in March

- Australia Westpac Consumer Confidence Index for April -17.7% m/m (prior -3.8%)

- Gundlach says the Fed has failed and is fundamentally broken

- Oil - Texas shale explorer says it'll halt drilling if state imposes OPEC-style production caps

- Chile - dead coronavirus patients are counted as recovered because they are "no longer contagious" (apparently this policy has been reversed)

- Australia ANZ/Roy Morgan weekly consumer confidence: 78.2 (prior 71.9)

- Goldman Sachs ridicule comments that oil cuts will amount to 20m bpd

- PBOC may cut its MLF rate on Friday (added - they did so today instead)

- Trump says some states can reopen almost immediately

- Trump says he expects stock market to top records soon

- Analysis suggesting the US dollar has topped out

- US President Trump halts funding to the WHO

- Bank of Canada monetary policy announcement - CAD is likely to be way more volatile than usual

- New York City has revised its coronavirus death toll very sharply higher, to more than 10,000

- Coronavirus - Divergence in the lock down approach in Europe - some easing, some tightening

- Airline bailout - US$25bn in direct aid to passenger airlines hit hard by the coronavirus

- 5pm on the US east coast and 'so far' today virus deaths are at a new record for the country

- 3 cities in China further postpone school start dates - COVID-19 cases increase

- Trade ideas thread - Wednesday 15 April 2020

- NY Fed's Logan comments on abnormal market functioning

- Private oil inventory survey shows larger then expected build

- Fed's Barkin - thinking through what the economic recovery will look like

- ICYMI - IMF says Australia's economy likely one of the worst-hit in the Asian region

The Australian and New Zealand dollars were sold for yen during the session here today, as evidenced by lower for the crosses. Apart from the background news items (coronavirus related) there was really not to much fresh to act as a catalyst for the move. Of note from Australia today was pricing for a hefty bond issue (Nov 2024 bond) and consumer confidence plunged. Keep in mind that the magnitude of the FX moves today were not large.

Equities were a little softer also, which fits with the less attractive risk theme for the session. Coming up during the US timezone today is data - specifically retail sales and the Federal Reserve Beige Book. Its difficult to think there will be much positive from either. Stock earnings announcement are likely to be downbeat also.

Cable is a little lower, as is EUR/USD (though you'll have to look closely). Ahead of the Bank of Canada meeting today USD/CAD is a touch stronger on the session here. Last month the BoC took aggressive easing action, perhaps we get more asset purchase indications from them today (or perhaps not - something to watch) or even some indication of how the Bank is assessing the prospect for negative rates ahead.

Gold drifted a little lower during the session.

The PBOC cuts its MLF borrowing cost to its lowest on record (2.95% from 3.15% prior). The Bank inject 100bn yuan for 1 year in the operation, and with an MLF maturing this Friday coming expect another then. The lower MLF should translate to a lower loan prime rate (LPR) at the monthly setting due Monday (20th).

---

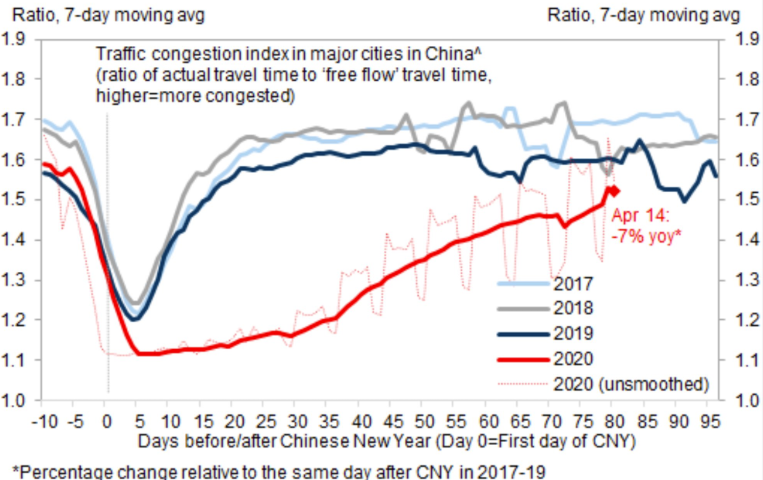

Graph via Goldman Sachs showing traffic congestion in China 'improving') ie, getting worse!