Forex news for Asia trading on Thursday 16th September 2021

- China is to release further from its reserves of aluminium, since and copper.

- Moody's - Australia's strong vaccine take-up and national reopening plan will guide a broad recovery ... for airports!

- The Reserve Bank of Australia has published its latest 'bulletin' - China a focus

- A heads up on the race to become the new Japan Prime Minister - Kono the favourite

- AUD/USD a few tics lower after the good news/bad news (net bad news) jobs report

- Australia jobs report: Employment Change -146.3K (vs expected -90K) & Unemployment Rate 4.5% (expected 4.9%)

- AMC says it will accept payment in Ethereum, Litecon and Bitcoin Cash

- PBOC sets USD/ CNY reference rate for today at 6.4330 (vs. estimate at 6.4354)

- Australian states report a jump in new local COVID-19 cases

- Australia Consumer Inflation Expectations for September: 4.4% (previous 3.3%)

- NZ PM Ardern says Australian nuclear-powered submarines will be banned from entering New Zealand's waters

- Friday September 17 the end of an era, CME will delist its standard-size S&P 500 contracts

- Morgan Stanley bullish AUD crosses, time to buy AUD/USD "may be drawing closer"

- Japan trade balance for August Y -635.4bn (expected Y -47.7bn)

- Reserve Bank of Australia release its snapshot of Key Economic Indicators

- Morgan Stanley says OPEC will balance the oil market in 2022

- Survey of Japanese firms: 80% see COVID-19 dissipating by end FY 2022

- New Zealand GDP for Q2 2021 +2.8% q/q (expected 1.4%)

- China's US embassy says US, UK, Australia should 'shake off' their cold-war mentality

- Expectations grow of a PBOC RRR cut in October - but Monday could bring a rate cut

- North Korea's latest test missile firing was launched from a train

- The United Arab Emirates to increase investment in the UK

- US President Biden, UK PM Johnson, Australian PM Morrison jointly speaking

- M5.6 earthquake - China (Sichuan)

- ICYMI - Bridgewater founder Dalio: "I have a certain amount of money in bitcoin"

- Trade ideas thread - Thursday 16 September 2021

- US House advances tax plan (higher corp tax, higher tax on wealthy)

- Coronavirus - Moderna highlights new clinical data, improved vaccine performance

The monthly Australian labour market report has two 'headlines', the net number of jobs gained or lost and the unemployment rate. Today we got the August report.

For the first, 146,300 jobs were lost

And for the second, the unemployment rate fell! To 4.5% from its prior reading 4.6%

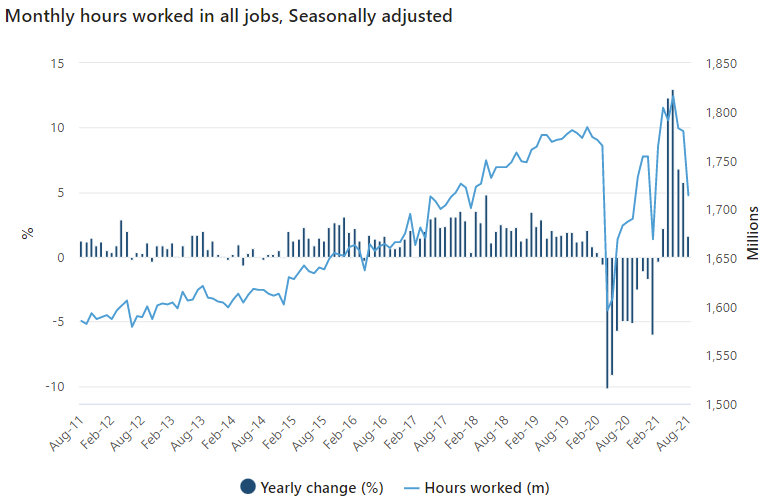

That jobless rate appears a good result, but it came from a big, big drop in labour force participation as many unemployed people could not physically leave their homes to search for work due to lockdowns and thus withdrew from the labour force. This is terrible news. The Australian Bureau of Statistics gave guidance on the report to the effect that the best indicator to look at was the 'hours worked' on the month, which fell a huge 3.7% on the month. Again, terrible (graphic below).

AUD/USD has dribbled a little lower since the data were published but the net movement on the day is small only. NZD/USD has dipped a little alongside. Q2 GDP data from New Zealand out earlier in the session was impressive, the economy had considerable momentum heading into Q3.

USD/CAD is up a little while EUR/USD and GBP/USD are not much changed with no news nor data.

In China, iron ore fell again as expectations of weaker demand remain firmly rooted with the campaign to cut steel production remaining a focus. China iron ore futures are at their lowest since the middle of 2020.

On the Geo-Political front US President Biden, UK PM Johnson, and Australian PM Morrison announced a new security alliance between the three counties (the awkwardly named AUKUS alliance) - Australia will get nuclear-powered submarines for the first time, and Tomahawk missiles, amongst other weapons.

The favourite to become the next Japanese Prime Minister, Taro Kono, appeared to pull further ahead in the race.

Hours worked in Australia in August plunged: