Forex news for New York trading on November 10, 2017.

- Nasdaq unchanged. S&P and Dow down.

- Not a good day for bitcoin owners. Also down on the week.

- CFTC Commitments of Traders will not be released today due to holiday

- Key events and releases for the November 13 to 17 trading week

- US crude oil futures closing the week at $56.78

- US Treasury Secretary Mnuchin: We will reconcile differences between tax bills

- More Bullard: Global economy does not seem to have obvious weak spots

- Canadian trade minister: TPP nations have made good progress on deal...

- Fed's Bullard on radio interview: Fed policy is about right where it is

- Baker Hughes oil rig count 738 versus 729 last week

- TPP Nations have "agreed on the core elements of a deal": Reuters

- European stocks end the session lower on the day

- NY Fed GDP Nowcast for Q4 at 3.2%

- Cable poised to finish the week at its best levels. Why it gained.

- US cautions against using Lebanon as a venue for a proxy conflict

- U Mich consumer sentiment 97.8 vs 100.9 expected

- Abe video shows what it's like to be a yen trader

- It's time for a vacation

- The GBP is the strongest and the AUD is the weakest as the NA day begins

- ForexLive morning news wrap: A mixed bag as the week draws to a close

A snapshot of other markets as the week comes to a close shows:

- Spot gold is ending the session down at $9 or -0.75% at $1276

- WTI crude oil futures are ending the week down $.32 or -0.56% at $56.85

- US yields move sharply higher in trading today especially the longer end. Two-year 1.6541%, +2 basis points. Five-year 2.0548%, +4.3 basis points. 10 year 2.402%, +6 basis points. 30 year 2.8837%, +6.7 basis points

- US major stock indices ended mostly lower. NASDAQ composite index was unchanged. S&P index fell by -0.09%. Dow Jones industrial average fell by -0.17%.

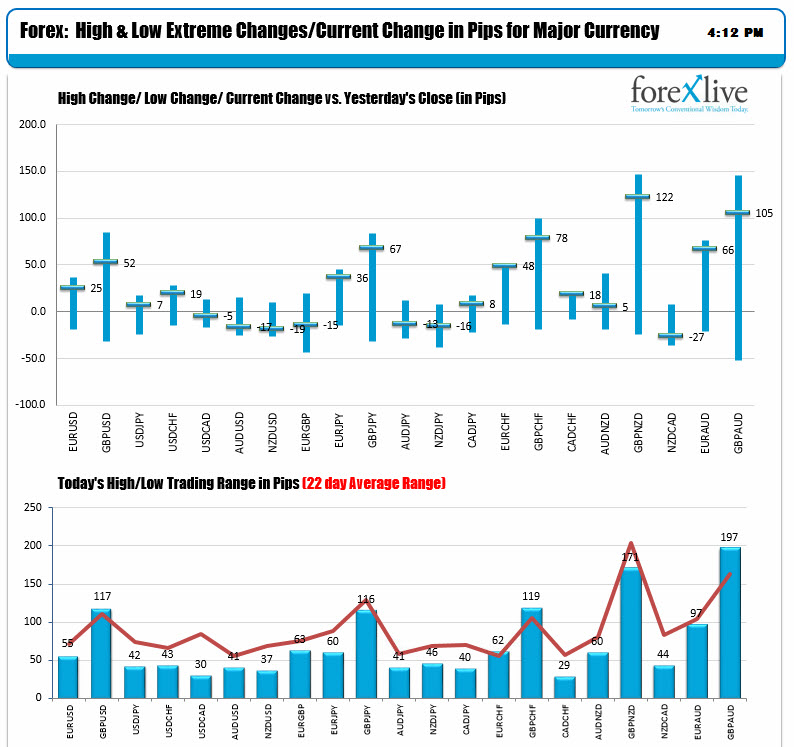

It was a quiet ending to the week for the most part in the NY session. The major indices vs the USD were mostly well below the 22 day average trading ranges for the day. The one exception was the GBPUSD which was able to move higher by 52 pip or 0.40% vs the greenback and had a 117 pip trading range for the day.

Other pairs like the EURUSD were able to extend the trading range in the NY session, but at 55 pip total range for the day, the pair was not racing. The USDJPY's range was only 42 pips and is ending only 7 pips from the prior day close. The USDCAD could only manage 30 pips from low to high (ending down -5 pips). The AUDUSD and NZDUSD at 41 and 37 pips total range, were also indicative of a lethargic Friday.

The one piece of economic new out today came from the Michigan Consumer sentiment index. It came in less than expectations at 97.8 vs 100.9 and the major pairs did see the USD weaken toward session lows for the greenback. However, when the market stepped back and realized even at 97.8, the sentiment was near high levels going back to 2005, the dollar selling dried up.

Also helping the dollar (and perhaps keeping the selling at bay) was the rise in yields. The 10 year yield was trading at around 2.30% at the lows this week. That was right around the key 200 day MA at 2.31%. However, the last two days has seen a move back higher. Today the yield on the bell weather note reached a peak of 2.4037% (closing near 2.398% - up 6.3 bps). That rise helped to support the greenback - at least a bit.

Some key technical thought at weeks end:

The EURUSD moved above the August swing low at 1.1661, the October 6 swing low at 1.1668 and even back above neckline on the head and shoulder formation from the daily chart at 1.1673. However, the price could only get to 1.1677 before turning around. The pair is closing the week at 1.1662 area which is still within a few pips of spoiling the "Head and Shoulder's Party" - which is getting a bit long in the tooth anyway - two week old and minimal momentum lower. The range for the EURUSD over the last two weeks is only 138 pips. That is not a lot. So next week, look for something more and either it will be a failure of the H&S break lower trade (and it goes higher) or the price cracks back below the 200 and 100 hour MA at 1.1622 and 1.1612 respectively and picks up a head of steam lower.

The USDJPY on Monday had its shot to move higher. On that day, the price moved above a quadruple top area between 114.39-49 but stalled at 114.73 before heading back lower. The fall took the price toward the 50% of the range for the year at 112.96. The low stalled at 113.07. The price today was able to stay mostly below a swing area defined by a bunch of swing levels in the 113.51-58 range. That area will be a barometer for bullish or bearish in the new week. If the price kicks higher, the 100 and 200 hour MAs at 113.68 and 113.848 will be eyed. Stay below those levels and the selling could see a move below the 113.187 and then the 112.96 level.

The GBPUSD moved above the 200 bar MA on the 4-hour chart at 1.32086 when the dollar was getting hit. The break was short lived and the price moved back below that MA line. It closed near the midpoint of the trading range since October at 1.31818 and above the 100 bar MA on the 4-hour chart at 1.3165. That 100 bar MA is key going into the new trading day. Why? Prior to today, the price of the GBPUSD stalled 4 times just below that line. Today it was broken and traded above for the rest of the day. So if the price stays above, the buyers are making a play. They may eventually fail because of Brexit concerns or lack of follow through like we saw today. However, if it stays above, they are trying to wrestle control from the shorts. A move below that MA at 1.3165 and the 100 day MA at 1.31096 becomes the next key focus. This week the pair did trade below that key MA level, but momentum could not be sustained.