Forex news for December 14, 2015:

- US stocks erase earlier losses. End up on the day.

- High Yield ETF (HYG) showing the pressure

- EURUSD slipping toward corrective targets

- Moody's: Fed rate rise would underscore US strength

- Shares of FXCM surge 65% on attempt to restructure deal

- Canada FM Morneau: Goal to balance budget by 2019/20

- Monday motivation: How to score a market knockout

- There's only one trade this week says Morgan Stanley

- US stocks whipping around a bit. Crude oil back to unchanged.

- Euro cross play even more evident as EURCAD turns around the turnaround

- Forex technical analysis: EURUSD moves to new day session highs

- ECB bought €13.599bn in latest QE count

- Do you want to know where stocks will go in 2016?

- November 2015 Canadian TeranetNational Bank HPI +0.2% vs -0.2% exp m/m

Only one piece of economic data was released during the North America session. The November 2015 Canadian home price index rose by 0.2% vs. -0.2% percent expectations. The release had little impact, as the USDCAD was more interested - early on at least - with the price of crude oil.

Oil prices fell below the $35 level and nearly reached new 11 year lows (just held above 2008 lows). That helped push the USDCAD to yet another 11 year high at 1.3780. However, when the gains could not be sustained, and oil prices started to rebound, the pair backed away and corrected to the 38.2% of the move up from last Wednesday's corrective low at 1.3679 (level to eye going forward). The rest of the day was spent consolidating in the middle of the trading range.

For other pairs against the US dollar, the EURUSD had one of those upside squeezes early in the day, helped by lower stock prices/lower oil. The move higher saw the EURUSD move back above the 200 day moving average at the 1.10313 level. The pair also moved above the high price from last week at 1.1042 level before stalling at 1.1048. As the major stock indices rebounded, the EURUSD reversed. A move below the 200 day MA gave traders a reason to sell, and the pair corrected lower into the close. Going into the new trading day, the 200 day MA will remain topside resistance at 1.1031. ON the downside, a move below the 100 hour MA at the 1.0962 and then the 1.0950 level will be eyed for more bearish clues.

The USDJPY followed the dollar lower as stocks and oil declines, but like the EURUSD, found a new extreme below the Friday low at 120.57 and the new low extended to 120.33. However when the pair could not reach and get below trend line support on both the hourly and daily charts at the 120.20 level, the correction higher began. Going forward be aware of the 121.57-64 area where the 100 and 200 day MA and 100 hour MA is located. This is a key technical level on a further correction higher.

The GBPUSD did most of it's work lower during the European morning session. That move took the price through the 100 hour MA, and to the the swing low from Thursday's trade at 1.5110. Buyers came in against the level. The rest of the day saw the price correct 38.2% of the move down from Friday's high at 1.5158. A move above that level will be eyed in the new day IF the momentum is to switch back to the upside.

The AUDUSD heads into the new trading day with the price between the 200 hour MA above at the 0.7277 level and the 100 hour MA below at the 0.7234 level. The RBA meeting minutes will be released later in the day and they may kick the pair outside one of these extremes.

EURGBP moved away from the 100 and 200 day MA today at the 0.7200 area and moved all the way to a month and a half high at 0.7300. However, sellers came in to push the pair back down toward the days midpoint. Look for support buyers at the 0.7250 level. Stay above more bullish. Move below and yet another test of the 100 and 200 day MAs may be in the cards (at 0.7200).

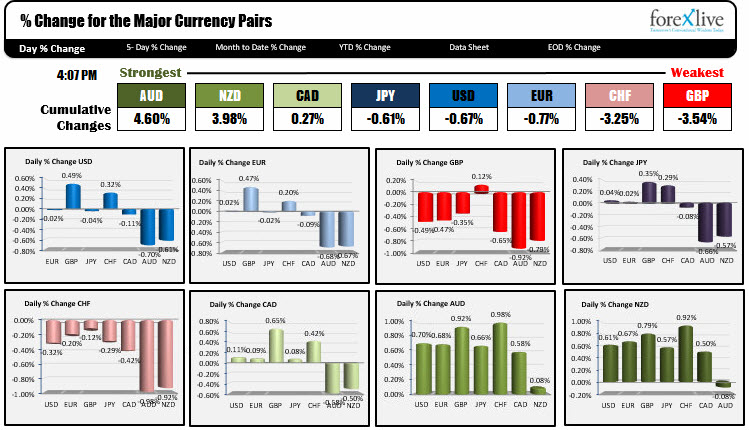

Below is a snapshot of the % changes of the major currencies vs. each other. The AUD was the strongest rising against all the major currencies, while the GBP was the weakest. The USD was mixed - falling against the NZD, AUD CAD and rising against the GBP and CHF. Against the EUR and JPY, the greenback was more or less unchanged.