Forex news for NY trading on May 15, 2019

- Major indices move higher today led by tech/high flying stocks

- China's Treasury holdings fell in March, according to TIC data

- China's holding of US Treasuries drop for the first time in 4 months

- Canada's Freeland: Had good conversation with Lighthizer Wednesday

- Oil bounces back to finish the day higher after US inventory report

- If the US economy is so hot then why are credit card charge-offs rising?

- Fed's Barkin: Watching closely for trade war impact on confidence

- Trump 'had it out' with Kudlow after economic advisor contradicted him

- Mexico and US have substantially reached an agreement to remove metals tariffs - report

- Fed's Barkin: Makes sense to remain patient on rate outlook

- Axios: US delegation may head to China for trade talks as early as next week

- Atlanta Fed GDPNow forecast cut to 1.1% from 1.6% last

- European shares recover and are closing higher on the day

- Coeure: Global slowdown has delayed ECB normalization

- CNBC: Lighthizer is proposing plan to get rid of steel and aluminum tariffs

- US weekly crude oil inventories +5431K vs -1200K expected

- Trump to delay decision on auto tariff imports for up to six months - report

- US May NAHB home builder sentiment 66 vs 64 expected

- US March business inventories 0.0% vs 0.0% expected

- Mnuchin says in 'serious' talks with China to improve trade ties

- US April industrial production -0.5% vs 0.0% expected

- US advance retail sales for April -0.2% vs +0.2% estimate

- US May Empire Fed +17.8 vs +8.0 expected

- Canada April CPI +2.0% vs +2.0% expected

- The JPY is the strongest and the AUD the weakest as anxiety increases today

In other markets:

- Spot gold $-.50 or -0.04% at $1296.40

- WTI crude oil futures +$.34 or 0.53% $62.12

The markets have been preoccupied with trade concerns of late. So having a nice juicy economic number like US retail sales was something different. The data for the retail sales disapointed with the headline number -0.2% vs +0.2% estimate and ex food and energy also coming in weaker at -0.2% vs -0.3%. Not good numbers.

Later industrial production also came in much weaker at -0.5% vs 0.0% estimate.

So prior to the US stock market opening, stocks started to move back lower. USDJPY and JPY crosses were heading south. The JPY crosses tumbling, dragged the EURUSD and GBPUSD lower in support of the EURJPY and GBPJPYs falls.

And then the trade headlines started to come out of Washington.

First it was Mnuchin saying he is in "serious talks" with China to improve trade ties. That is nothing new, but "serious talks" was maybe a ratcheting up from the oh so famiilar, "trade talks are progressing" soundbite.

Next, came a headline from the White House that Trump was to delay the decision on EU auto tariff imports for up to 6 months. Remember that threat? Well there seems to be a "stay of execution" for a while.

That helped to send the EURUSD from around 1.1183 to a high of 1.1224 (right at the 100 hour MA), before backing off.

Finally, to complete the Trifecta, CNBC reported that US trade representative Lighthizer is proposing a plan to get rid of steel and aluminum tarriffs on Canada and Mexico. Remember those old tariffs that were to be removed after the USMC trade agreement way back when was agreed. Well they never were. In fact the USDMC trade agreement that got rid of the NAFTA agreement is still not signed/executed. HMMMM.

So all that helped lead to the USDJPY rallying. The JPY crosses also rallied back higher, and stocks turned from negative to positive (S&P was down about 20 points and ended up 16 points and the Nasdaq went from -53 points to +87 points at the close).

That's life in the financial markets with tariff bingo going on.

The one thing we continue to learn is that if the going gets tough in the stock market in particular, something from Pres. Trump, Mnuchin, Lighthizer, etc (or all of the above) is just a a tweet or comment to the eager press corp away.

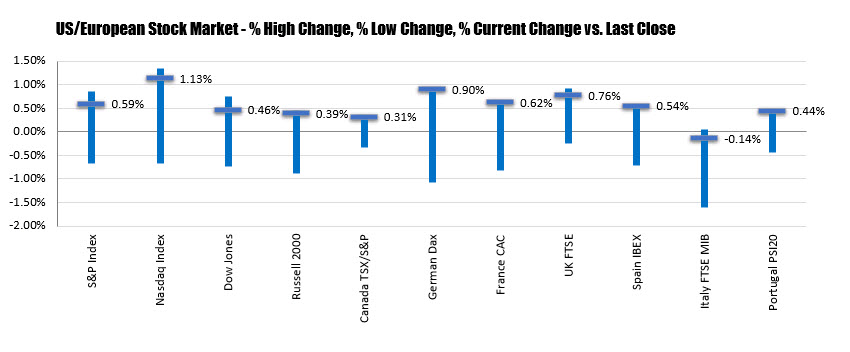

Below is the low, high and close for the major indices today. The markets, snatched victory from the jaws of defeat.

In the forex market, currency pairs were admittedly all over the place. The GBP ended the weakest. The UK government and internal Brexit negotiations is simply dysfunctional, leading to the GBP weakness. The CAD was the strongest helped by a technicall fall below its 100 and 200 hour MA at 1.3454-58 area.