Forex news for New York trading on September 15, 2017

- Bitcoin technicals: 100 hour MA stalls the bitcoin rally....

- Crude oil futures end the day unchanged on the day

- Foreign policy is on the agenda next week: Trump to hold many meetings

- Goldman Sachs cuts Q3 GDP growth view to 1.6% from 2.0%

- McMaster: US is approaching the end of the road for diplomacy on North Korea

- What does a near 500 pip trading range do for the technicals in GBPJPY?

- Baker Hughes US oil rig count 749 vs 756 prior

- Friday fun: The ECB's spirit animal

- ECB's Visco says Italian economy to grow 1.5% in 2017

- Atlanta Fed GDPNow cut to 2.2% from 3.0% prior

- Mark Carney will have no credibility left if the Bank of England doesn't hike this time

- Not a great ending to the week for European stocks. UK FTSE the dog again

- Bitcoin technicals: Snap back rally after test/break of June swing high fails

- New York Fed GDP Nowcast 1.3% versus 2.1% prior

- There is a new hurricane threat in the Atlantic

- US business inventories for July 0.2% vs. 0.2% estimate

- August prelim U Mich consumer sentiment 95.3 vs 95.0 expected

- August industrial production -0.9% vs +0.1% expected

- Canada August existing home sales +1.3 vs -2.1% prior

- US empire manufacturing index for September 24.4 vs 18.0 estimate

- US August advance retail sales -0.2% vs +0.1% expected

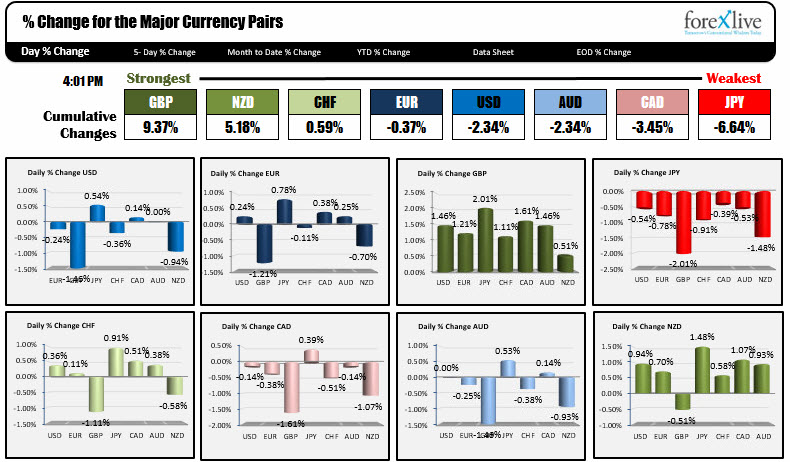

- The GBP continues its surge (strongest). The JPY is getting smashed.

The snapshot of other markets shows:

- Spot gold is trading at $1320.70, down -$8.92 or -0.67%. Despite a missile launch from N. Korea and continued threats from the US, the price of gold was not bothered

- WTI crude oil futures settled unchanged on the day at $49.89.

- US yield moved modestly higher. 2 year yields 1.382%, up 2 bp. 5 year 1.8039%, up 2.7 bp. 10 year 2.2023%, up 1.7 bp. 30 year 2.77%, unchanged. The yield on the 10 year settled at 2.052% after moving to a low of 2.01% last week. So, for the week, yields are up 15 bps. The high yield reached 2.2234%

- US stocks are ending the session and week higher. The S&P closed up 4.61 points at 2500.23. The Nasdaq closed up 19.38 points or 0.30%. The Dow posted the best week of the year and ended the day up 64.86 points or +0.29%

The US retail sales came in softer than expected at -0.2% vs. +0.1%. All the other measures of the report were also weaker than expectations (Ex auto +0.2% vs +0.5% est and Control group -0.2% vs +0.2% estimate). Not good but hurricane effects may have been an impact.

Industrial production and capacity utilization was up next and it too surprised with a -0.9% decline vs +0.1% estimate for IP and Cap. utilization coming in at 76.1 vs 76.7 estimate. The Fed did say the impact from Harvey was worth -0.75%.

Preliminary Univ of Michigan consumer sentiment came in a little better than expectations at 95.3 vs 95.0 and inventories were as expected.

The impact of the weaker data was evident in the estimates for GDP from the main Fed surveys. The NY Fed Nowcast now sees the 3Q GDP at 1.3% vs 2.1% last week. The Atlanta Fed's GDPNow estimate was also sharply lower at 2.2% vs 3.0% last week.

The Fed will meet next week and although the data they and the market are and will see will be along the same lines of the data today (at least in the short run) and although it may lead to a 3rd quarter GDP that is south of even the 2% level, the Fed will likely look past it, and expect higher growth in the 4Q on the rebuild.

As a result, in the forex market today (you can add the stock and bond market too), the dollar did not get slaughtered (see % changes of the major currencies vs each other in the charts above).

The greenback was still lower by a bit, but that was more a function of the sharp rise in the GBP and NZD today. The GBPUSD pair rose nearly 1.5% (dollar down -1.5%), while the NZDUSD increased by 0.94% (dollar down by -0.94%) Versus the other major currency pairs, the dollar was mixed - down modestly vs the EUR, and CHF, but higher against the JPY and CAD. It was unchanged vs. the AUD.

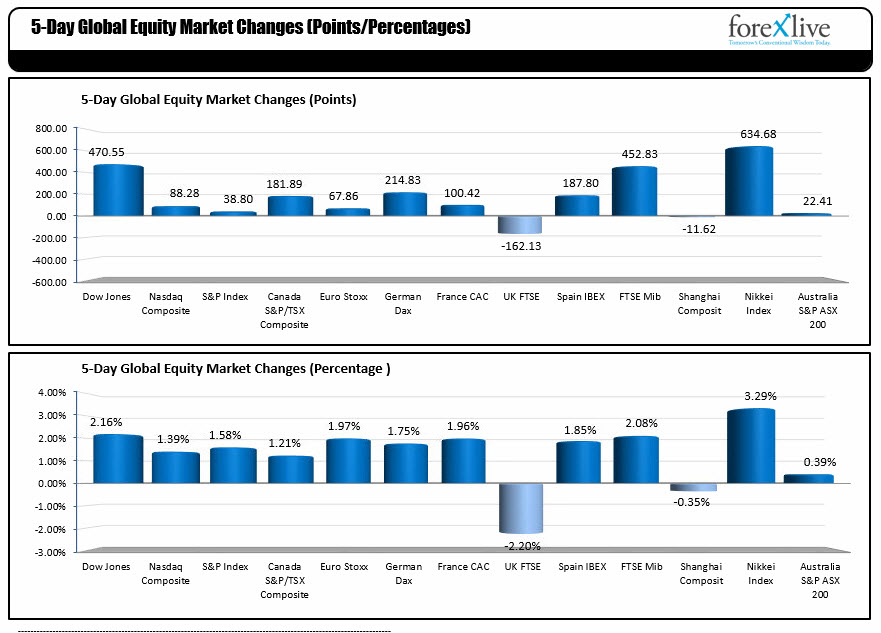

In the US stock market, traders ignored the weaker economic data and closed the major indices with gains across the board. For the week the Dow enjoyed the best week of the year up 2.16%. The S&P index tacked on 1.58% while the Nasdaq added 1.39%. Not a bad week for the US indices once again.

Below is a look at the week changes for the major global stock markets. The only major index that was down significantly was the UK FTSE (the Shanghai composite also fell but it was only by -0.35%).

What was the catalyst for the FTSE -2.20% decline this week?

The much higher GBP as a result of the hawkish comments from the BOE and it's leader Mark Carney. Carney pretty much locked himself in for a hike at the next meeting. The market is lagging that lock a bit at 65% chance for a hike at the next meeting (see Adam's post on how Carney's reputation is on the line). Nevertheless, his hawkish comments were still was good enough for GBPUSD to move up nearly 196 pips and the GBPJPY to rise by nearly 300 pips in trading today. The EURGBP fell by -108 pips as well. The GBP is on fire and it is a direct result of the tightening overtures from the BOE and it's leader.

In the US debt market today, the US yields are ending the day higher. For the week, the 10 year yield was up about 15 basis points. That is another indication the markets are ignoring the weaker data. Be aware. The pattern should continue as the impact from hurricane's Harvey and Irma make it's way into the data.