Forex news for Americas trading December 17, 2015

- December 2015 US Philly Fed business outlook survey -5.9 vs +1.5 exp

- US Initial jobless claims come in at 271K vs. 282K prior. 275K estimate

- Fed accepts $105.1B at 0.25% in first reverse repo operation

- Bank of Mexico lifts rates to 3.25% from 3.00%

- Stocks end the day at the lows

- It IS hard to ignore this area for the EURUSD (so don't)

- Technical analysis: Crude oil pushes toward the lows

- Fed accepts $105.1B at 0.25% in first reverse repo operation

- European stocks don't share in their US cousins demise

- There's far too much going on to get a true handle on moves right now

- I can stop a train with a single post...

- It's too early to comment on the effect on the FX rate from Fed hike says Nowotny

- Nowotny: ECB can adjust non-standard tools in both directions

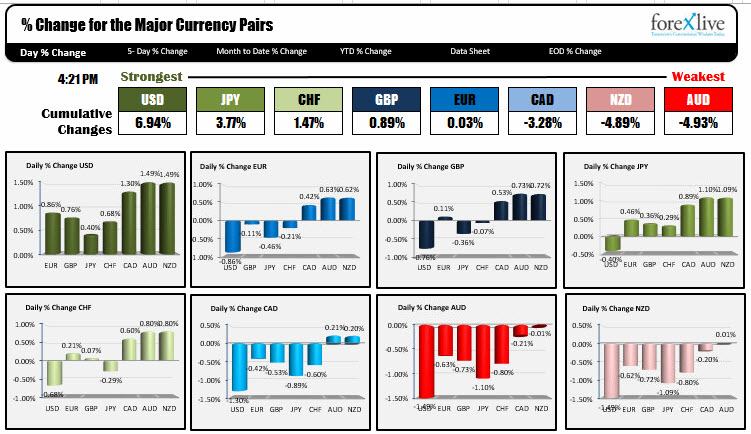

The US dollar was the strongest currency in trading today one day after the Fed started liftoff by raising rates by 25 basis points. The move was the first increase in 9 years. Also impacting the dollar was a continued fall in commodity prices. Oil fell back below the $35 level, and the CRB index reached another 13+ year low (going back to March of 2002). US initial claims came in steady at 271K (the 4-week average is 270.5K). The Philly Fed index was weaker than expected.

The EURUSD started its fall in the Asia-Pacific session and continued it's decline in the NA session. The low reached 1.08019. The 100 bar MA on the 4 hour chart comes in at 1.08017. That and other support including the 200 bar MA on the same 4-hour chart, the 50% of the move up from the December low and other lows from post ECB day all between 1.0777 and 1.0802 will make that area a tough nut to crack in the new trading day (See post).

The USDJPYs move higher took it back into the heart of the non trending area that confined the pair trading from Nov 6 to Dec 9 (see post outlining the technicals). In the new trading day, watch for support against the 122.42-50 area. A move below has additional support at the 122.02-29. If the range trading is to reestablish itself and the pair move toward the upper extreme, those levels will be eyed as a support level.

The GBPUSD fell to new lows going back to April 21, 2015 despite much better than expected Retail sales earlier in the day. The low from Dec 3 at 1.4894 was broken (low reached 1.4864. However, a late day rally, has taken the price back toward the 1.4900 level at the close.

The commodity currencies were rocked today. The USDCAD traded above the 2004 year high at 1.3966 on it's way to a new 12 year high at 1.3985. The AUDUSD fell below the 100 day MA and approached key trend line support against a lower trend line at 0.7085 (see post here). The low reached 0.7096 and the pair corrected higher into the close. Watch this level on a test in the new trading day. The NZDUSD fell back below the 200 hour MA at the 0.67168 and stayed below for most of the NY session. This will now be resistance on a correction if the sellers are to remain in control.

AZN Business confidence and Japan Monetary policy statement is due out in the Asia pacific session. Tomorrow Canada CPI and wholesale sales. In the US, Flash services PMI will end the week. It is also a quadruple witching day.. Quadruple witching is the simultaneous expiration of stock-index futures, stock-index options, single-stock options and single-stock futures. It often leads to increased volatility in the equities (as if there has not been a lot of that of late).

Below are the % changes of the major currencies vs. each other. The USD rose against all the major currencies, while the AUD was the weakest - falling against all the major currencies.