Forex news for US trading on Feb 17, 2016:

- FOMC Minutes: Many Fed officials saw increased downside risks

- Brazil downgraded to junk by S&P

- S&P cuts Saudi Arabia sovereign credit rating to A- from A+ - Qatar unchanged, Oman cut also

- EU's Tusk says UK deal not guaranteed

- Mexican central bank increases overnight rate by 50 bps

- Mexican government to cut spending because of low oil prices

- Iran supports cooperation between OPEC members to stabilise prices

- Libya supports any freezing output deal but they want to increase production first

- January 2016 US industrial production +0.9% vs +0.4% exp m/m

- Fed is laser focused on its dual mandate says Kashkari

- US January PPI +0.1% vs -0.2% m/m expected

- January 2016 US housing starts 1.099m vs 1.170m exp

- Germany's Merkel says Tusk proposals are a very good basis for UK deal

- Fed's Kashkari says Fed could communicate better - FT

Markets:

- Gold up $8 to $1208

- WTI crude oil up $1.56 to $30.61

- S&P 500 up 30 points to 1926

- US 10-year yields up 4 bps to 1.81%

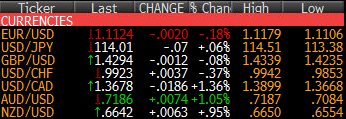

- CAD leads, CHF lags

The Canadian dollar along with the rest of the commodity currencies surged ahead on Wednesday as crude oil rose 5.3% and risk appetite improved. USD/CAD touched 1.3900 in Europe then embarked on a steep drop down to 1.3680 at the London fix. It shopped back to 1.3725 from there before a drop to fresh session lows after the API data.

The FOMC Minutes were the highlight of the day. As usual, the headlines delivered a little something for everyone. The USD bulls like that most members still saw gradual hikes and a return to 2% inflation. The bears liked the note about increased downside risks.

EUR/USD initially hit a US high at 1.1155 after the data but quickly reversed down to 1.1120. Then bounced 30 pips and is now at 1.1124. The entirety of the move was within the earlier European and Asian ranges.

USD/JPY found some buyers ahead of the London fix as risk appetite improved but the pair slid after the minutes to 113.80 from 114.20. It was a choppy move and we finish near 114.00.

Cable traced out an unusual pattern after yesterday's sharp drop. It skidded sideways for most of the day then broke lower only to retrace and move higher but offers at 1.4340 held. Then it was down to the lows again (they held) and back up to the highs (which also held). The pair finishes virtually flat.

AUD/USD is in focus ahead of the Australian jobs report. The consensus is for a +13K reading and the Aussie is perky ahead of the number at 0.7185, the highest since Feb 4. It traded at 0.7110 at the start of US trading and rode higher on commodity prices and risk sentiment.