Forex news for US trading on November 21, 2017

- US stocks close with good gains and record levels

- Oil - heads up for the inventory data due around the bottom of the hour

- Yellen to speak later, what to expect

- AUD/USD: Hit fresh lows; where to target? - BNPP

- Bitcoin update: Cracks below the MA on the 5- minute and runs lower

- US WTI crude oil futures settle at $56.83

- JPMorgan might be having second thoughts on Bitcoin

- Lebanon's Hariri is on his way home

- Retail traders can access a real-time FX tape

- Bitcoin technical analysis: Trades to new record highs (after a 6% fall)

- US tax reform has lost Martin Wolf's vote

- Crypto hack can't stop Bitcoin's march

- ECB's Coeure: Expect link between QE and inflation in policy message to be changed over time

- European stocks end session with solid gains. Yields lower.

- USD/JPY claws back losses as S&P 500 hits 2600 for the first time

- Zimbabwe President Robert Mugabe has resigned, speaker says

- German politics unlikely to change euro's course. Buy the dips - Credit Agricole

- October US existing home sales 5.48m vs 5.40m expected

- New Zealand GlobalDairyTrade auction -3.4%

- Foreign buying of London real estate boomed this year, despite Brexit

- Philly Fed Nov non-manufacturing index 19.3 vs 32.2 prior

- Chicago Fed national activity index or October 0.65 vs. 0.20 estimate

- Canada Sept wholesale trade sales -1.2% vs +0.6%

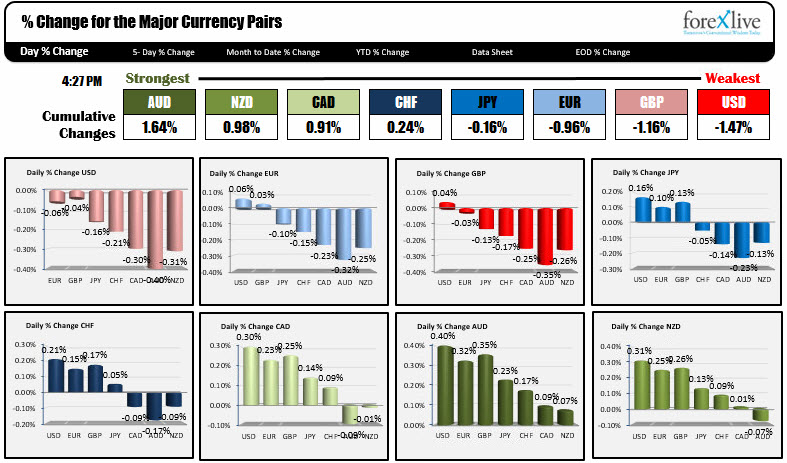

- The AUD is the strongest, while the EUR is the weakest as NA traders enter

- ForexLive morning news wrap: It's the pound's turn to take a roller-coaster ride

In other markets, the snapshot at the end of the day shows:

- Spot gold is up $3.50 or 0.27% at $1280.35. The high reach $1285 while the low extended to $1276.32

- WTI crude oil futures rose by 0.48 cents or +0.85% at $56.89. The price gapped above the 200 hour moving average at $56.24 and stayed above for the day. That level is a risk level for buyers in the new trading day.

- US yields saw a flattening of the yield curve again. Two-year yield 1.767%, up 1.7 basis points. 10 year yield 2.356%, -1.1 basis point. 30 year yield 2.759% down -2.1 basis points

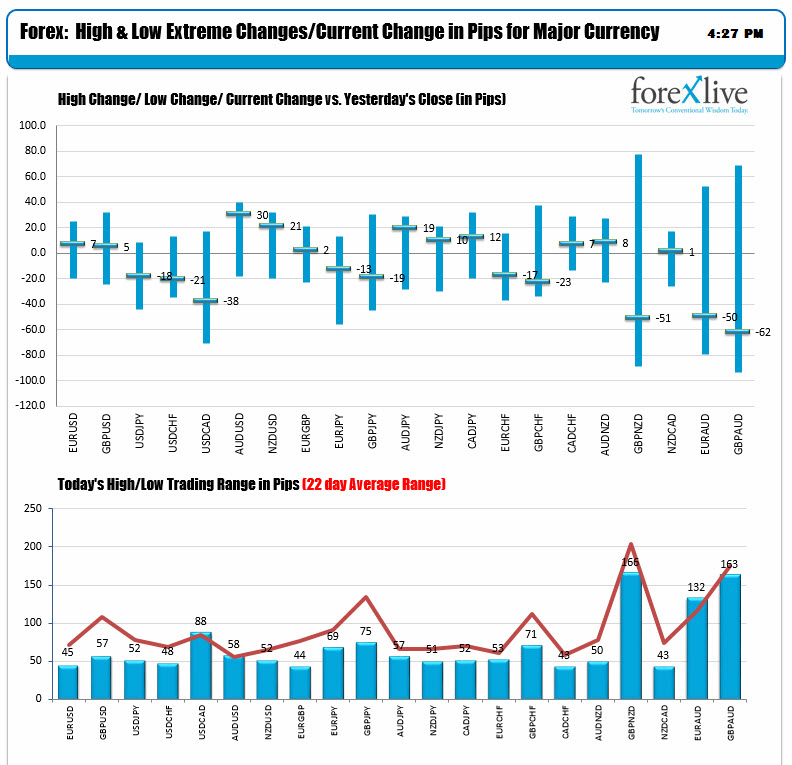

The forex markets were quiet today. Most of the major currency pairs and crosses could not get to their 22 day averages (see lower chart below). The EURUSD range was only 45 pips vs 65 average. The USDJPY range was 52 pips vs an average of 69 pips. The GBPUSD range was 59 pips vs an average of 97 pips. The USDCAD did reach its average range bogey. The 5th round of the NAFTA talks ended without much progress, but that did not hurt the CAD. It was rose vs the USD but ended off it's high too. The loonie also rose despite a sharp fall in wholesale trade sales.

Fundamentally, in the US the Chicago Fed National Activity index, a compilation of 85 economic indicators came in much better at 0.65 vs 0.20 estimate. The data had little impact though. Existing home sales were also better than expectations at 5.48M estimate vs 5.40M est. The supply of homes remains very low at 3.8 months. The tight supply especially in the lower end is pricing out the first time buyers.

Despite the better data, the US dollar was lower on the day. In fact it was the weakest currency of the day. the AUD was the strongest. Note, however, that relatively speaking, the changes were somewhat modest. The yield curve flattening may have traders in the greenback thinking the 3% growth we have been seeing, will not be so robust once the calendar changes to 2018. We will see, but the 2-10s spread did reach the lowest level since October 2007 (at 59 basis points).

Below are some technical thoughts on some of the major pairs:

EURUSD

The EURUSD traded in a narrow 45 pip trading range today with the 100 day MA at 1.1754 and the 38.2% of the move down from the September 8th high at 1.17587, stalling the upside. On the downside , a swing area at 1.1716-24 held support (the low reached 1.1713 today), and will be a level to get below if the sellers are to take more control. A fall lower would look toward the underside of a trend line at 1.1693. The 100 bar MA on the 4-hour chart comes in at 1.16772. If the price is able to crack and stay above the 100 day MA, a move back toward the 50% of the move down from the September high at 1.1822 will be eyed. That level stalled a rally on Friday.

USDJPY

The USDJPY could not get above its 100 hour MA. Well it did, but only for two 5-minute bars and the break was only good for 3 pips (above the MA line). The MA line is now down to 112.57 and moving lower by 1/2 pips per hour. That makes it easier for a technical break if it could muster another run higher in the new day. Although the pair is below the 100 hour MA, the stall yesterday at the 38.2% of the move up from the September low at 111.89 (the low came in at 111.87), AND the inability to get to the 100 and 200 day MA at 111.72 (they are converged there), makes me think the buyers want take control. They just need to a push. We can't expect miracles as tomorrow is the day before the US Thanksgiving day holiday, but if the Asian session finds a bid and is able to get above the 100 hour MA, maybe the ball gets rolling.