Forex news for North American traders on August 22, 2017

- US stocks end the day with strong gains on hope of tax reform

- USDJPY trades to new highs as stocks trade to new highs

- Hackers have found a vulnerability and are targeting BitCoin owners

- S&P and Nasdaq just can't turn the technical tide bearish for long

- US crude oil futures settle at $47.64/BBL

- Fed bank directors backed steady discount rate

- Geopolitical: China urges US to immediately correct its mistake on sanctions

- Little to suggest this is the turn for the US dollar - Credit Agricole

- Forex technical analysis: EURGBP finds sellers against topside trend line

- European stocks end the session with some strong gains

- New US sanctions against China and Russia

- Richmond Fed manufacturing index (Aug) 14 vs. +10 estimate

- FHFA house price index for June 0.1%vs 0.5% est

- Philadelphia Fed non manufacturing index 31.8% in August vs 23.4 in July

- Canada retail sales (June) 0.1% vs 0.2% estimate

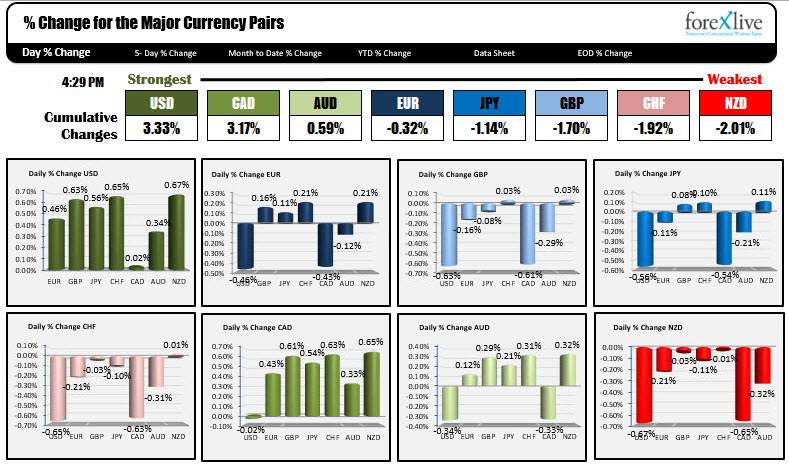

- The greenback takes the lead. The NZD is bringing up the rear.

In other markets, the snapshot shows:

- Spot gold reacted negatively to the US dollars gains today. It was down -$6.55 to 1285.33

- Crude oil futures are trading lower in late trading after private data showed an inventory build.

- US stocks (and European stocks as well) ended with strong gains. The S&P rose 0.99%. The Nasdaq was up 1.36%. The Dow was up 0.90%

- US interest rates rose helping the US dollar. The 2 year is trading at 1.321%, up 2 bp. 5 year is trading at 1.785%, up 3.4 bp. The 10 year is trading at 2.214%, up 3.3 bp. The 30 year is trading at 2.788%, up 2.5 bps.

The USD moved higher in trading today. The greenback was supported by talk of tax reform. Also European data was not that great today with the German ZEW sentiment index coming in at 10 vs 14 estimate. Concerns about Brexit and more bearish technicals did not help the GBPUSD (dollar higher). For the USDJPY, stocks which raced higher after a three straight days of declines, helped to push the dollar higher. The S&P was up nearly 1%. The Nasdaq did better at 1.36%. Happy days are here again for the US equities.

IN economic news today, the FHFA house price index saw a lower than expected gain of 0.1% vs 0.5% estimate. However, the house price purchase index for the 2Q did rise by 1.6% in the prior quarter.

Later (at 10 AM ET), the Federal Reserve bank of Richmond released the Richmond Fed manufacturing index for August. It came in better than expectations at 14 vs 10 estimate. That was unchanged from the prior month. The index has been above the 0 line since October 2016. The high water mark since that time is 19 (Feb 2017). So the index remains more near the upper levels for that regional indice.

Other than that the rise in stocks and the bond yields were the story for the day. Both the Nasdaq and the S&P close above their 50 day MAs at 6272 and 2450 respectively. Each tested their 100 day MAs yesterday at the corrective low. For bonds, the yields rose by 2- 3 basis points. That is not a heck of a lot but it did not hurt the greenback.

Below are the % changes of the major currencies vs each other. While the dollar was the strongest, the NZD was the weakest. The NZDUSD had a 0.67% change. The USDCHF and GBPUSD were not far behind. The CHF fell 0.65% vs the dollar while the GBP fell by 0.63% today.

The USDCAD was little changed. The CAD was supported by better ex auto retail sales for June. They rose by 0.7% vs estimate of 0.1%. The dollar was only up a fraction of a % against the CAD.