Forex news for US trading on January 22, 2016:

- Markit US January prelim PMI 52.7 vs 51.0 expected

- November 2015 Canadian retail sales +1.7% vs +0.2% exp m/m

- Canada December CPI 1.6% vs 1.7% y/y expected

- The world has become partly worse and partly better in last year says BOJ's Kuroda

- Underlying fundamentals in the UK economy are solid says BOE's Carney - WSJ

- CFTC Commitments of Traders report: Yen longs at highest since Feb 2012

- Baker Hughes 637 vs 650 last week

- S&P upgrades Greece's credit rating

- Bank of England: Increase in capital requirements tend to reduce lending

- US December leading index -0.2% vs -0.2% expected

- December 2015 US existing home sales 5.46m vs 5.20m exp

- December 2015 US Chicago Fed national activity index -0.22 vs -0.15 exp

- Spain entered 2016 at 3.5% GDP cruising speed says de Guindos

- ECB's Coeure: QE is working

Markets:

- Gold down $3 to $1098

- WTI crude up $2.72 to $32.25

- US 10-year yields up 2 bps to 2.05%

- S&P 500 up 38 points to 1907

- CAD leads on the week, JPY lags

There's an old saying that's perfect for the market this week. When the market trends, it's like an escalator; when it corrects, it's like an elevator.

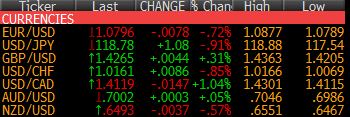

Massive, snap-back rallies have been the story late this week. None bigger than crude oil, which is a whopping 23% from Wednesday's low. The Canadian dollar continued to take full advantage as USD/CAD slumped another 150 pips to 1.4119. It finished at the lows, in a good sign for shorts.

USD/JPY also finishes very close to the highs of the day at 118.78. The Kuroda comments didn't hint at fresh stimulus and that put a nearly 50 pip speed bump into the market but it was soon washed out in a steady stream of buying.

Cable was underpinned by the same buying but it fizzled as London went home. The high of the day was at 1.4363 but we finish 100 pips lower as sellers stepped in over the past 4 hours of trading.

EUR/USD is back down to where it was after the ECB and it finished near the lows. Most of the damage was down before US traders arrived. A bump to 1.0837 was wiped out and it finished near the lows at 1.0793.

The Australian dollar was a strong performer early but sagged to finish flat on the day. We're keeping an eye on China over the weekend for stimulus or hints of a rate cut to come. That would put AUD in the spotlight when the market reopens.

Have a great weekend!