Forex news and economic trading headlines for Americas

- CFTC commitment of traders: Euro shorts increase. JPY longs decrease

- The Top 5 events/releases for the week starting July 25th

- Euro sits on the weekly low after German shooting spree

- Munich police say six dead, many injured at shopping centre; no other shooting sites

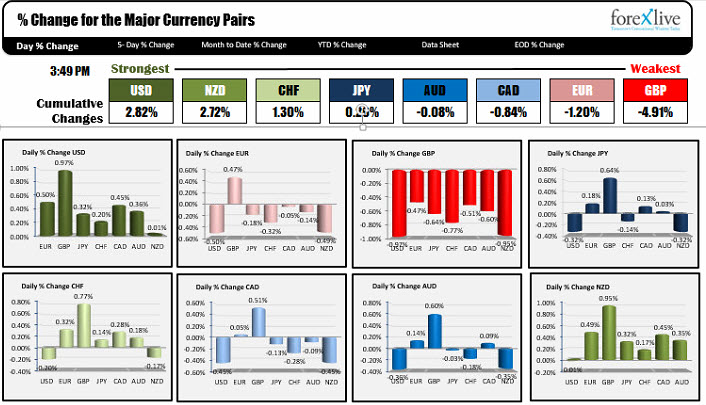

- The New Zealand dollar was the worst performer this week; USD led

- Fed will want to keep options open at FOMC - Barclays

- Baker Hughes US oil rig count 371 vs 357 prior

- Baker Hughes oil rig count to wrap up a rough week for oil

- Several people reportedly killed at Munich shopping centre

- Tim Kaine is a huge betting favorite to be named Clinton's vice-presidential pick

- Euro dumps as traders cover over the fix

- IMF's Lagarde to face trial in France

- July 2016 US Markit manufacturing PMI flash 52.9 vs 51.6

- Canadian June CPI 1.5% y/y vs 1.4% y/y expected

- June 2016 Canadian retail sales 0.2% vs 0.0% m/m

- ECB sources say there's no current urgency for action in September - BBG

Canada reported slightly higher retail sales and CPI data. Did it help the loonie? Well for a few minutes. After which the price of the USDCAD shot higher and shorts were forced to scramble. Oil prices fell today and trades at $44.15 down 1.27% on the day. That helped to support the USDCAD.

The US economic calendar was light with only the Markit PMI index coming out. It came in at 52.9 vs 51.5 estimate and up from 51.3 last month. I would have liked to say the data sent the USD higher - and the US dollar was the biggest gainer today - but much of the gain was in the GBP, and the rest was around the fixing time when traders were squaring up. Later after reports of another terrorist action - this time in Germany - the dollar go another nudge higher.

As for other individual pairs, the EURUSD started to fall around the time of the London fixing. At the time the range for the pair was about 35 pips. It is ending the day with a range of about 86. Moreover, the fall lower also extended the weeks trading range to 129 pips from what was 105 pips (or the lowest going back to August 2014). Better late than never but still a rather lethargic week in that pair.

The GBPUSD did all the heavy lifting after the better Service PMI today (48.8 vs 47.4). So what if the manufacturing index lower at 48.7 versus 49.1. The move took the pair to a lows of 1.3084 for the London morning session. The NA session took the pair down to a lower low but only by around 6 pips to 1.3078. Nevertheless, the bounces off the lows were minimal.

The USDJPY spent most of the day below the 100 hour MA. As London traders moved toward the exit, the pair moved above the key MA, but later fell lower after the headlines from Germany started to lead to appear. The pair moved lower on flight into safety flows.

The NZDUSD ended the week moving up and down. For the week, the pair was the weakest on the back of increased expectation of further rate cuts. The New Zealand government imposed tighter lending standards to help stem the rise in speculative home buying. However, room exists to add more stimulus to counteract slower growth, lower inflation and the rising NZD.

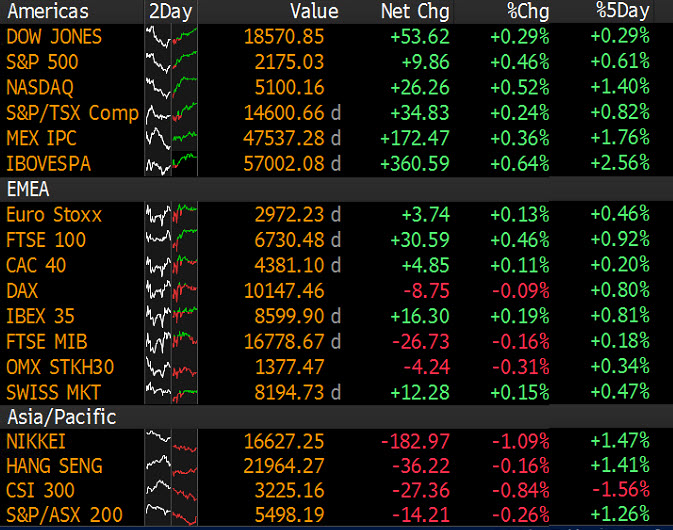

The global stock market saw most major indice rising for the week - albeit somewhat modestly. The US major indices saw the Nasdaq rise by 1.4% while the S&P was up 0.61%. In Europe, the UK FTSE led the gainers with a 0.92% increase for the week.