Forex news for North American trading on June 28, 2021.

- S&P and NASDAQ closing at record highs and near highs for the day

- WTI crude oil futures settle at $72.91

- Fed's Quarles says he doesn't think labor force participation needs to return to pre-covid levels

- Fed's Barkin: Fed has made substantial further progress on inflation

- Fed's Quarles: It seems unlikely that the US dollar's status would be threatened by a foreign CBDC

- Fed's Barkin: Expects inflation to moderate over time to normal levels

- UK health secretary Javid: We see no reason to go beyond July 19

- European equity close: Spain leads the way lower

- ECB's DeGuindos: The economic outlook is brightening

- Keep an eye on the London fix this week

- Dallas Fed June manufacturing index 31.1 vs 32.5 expected

- Falling Treasury yields weigh on USD/JPY

- Fed's Williams: Issues like access to central bank accounts need to be front and center

- OPEC+ forecasts point to August supply deficit of 1.5 mbpd in August - report

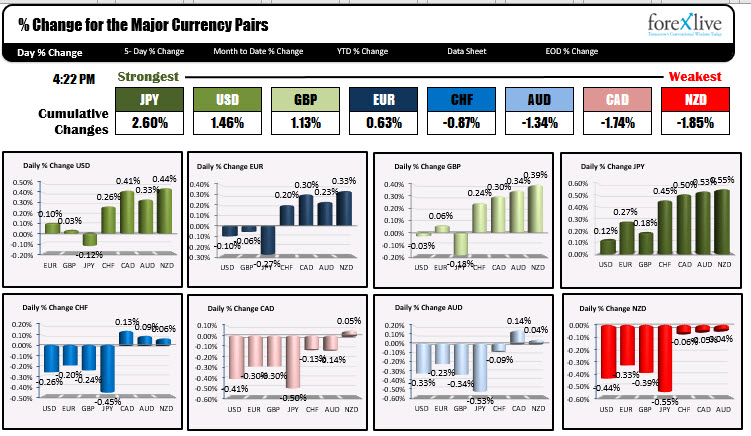

- The GBP is the strongest and the NZD is the weakest as the NA trading begins

- ECB's Weidmann says he wants to discuss conditions under which emergency policy ends

US rates went lower today with the 10 year yield moving down about 4.6 basis points (the 30 year was down -5.1 bps). That took the yield a few basis points below the 1.5% level. The most recent high reached 1.77%. The most recent swing low was down to 1.354%. So the yield is closer to the low of the range.

That move lower in yields helped to push the USDJPY lower but overall, the USD is ending the day higher (and only behind the JPY as the strongest of the majors). The NZD is the weakest of the majors. Recall last week, the NZD was the strongest of the majors before peaking on Friday and moving back down into the close (the NZDUSD was up 4 straight days until closing near unchanged on Friday).

The lower yields did help to push stocks higher along with a continued rotation into the big cap tech. In the last few hours of trading the shares of Facebook got a boost on the news that a district judge dismissed an antitrust case against the media giant. The Facebook shares rose 4.18%. Other big cap tech rose smartly with Intel up 2.81%, PayPal up 1.4%, Microsoft up 1.4% (record high)), Apple up 1.26%, Amazon up 1.25% and Netflix up 1.13%. On the negative side today, Boeing was lower on a report that a letter from the Federal Aviation Administration official to Boeing, said it is unlikely to receive certification for its 777X long-range aircraft until mid-to-late 2023 at the earliest.

Fundamentally, there was no major economic news today. Feds Barkin said he expects inflation to ease back toward the normal levels over time. Fed's Quarles said he doesn't think we need to see participation return to pre-covid levels because of baby boomer retirements.

Some key technical levels to eye in the new trading day:

- NZDUSD: The NZDUSD is trading between its 100 hour moving average above at 0.70518 and 200 hour moving average below at 0.70266. The 200 day moving averages between those bookends at 0.70430. In the new day traders will be looking for a shove outside the moving average extremes and hopefully momentum in the direction of the break.

- AUDUSD: The AUDUSD as the same moving averages in play - but in a different order. The price remains below its 100 hour moving average at 0.75765, above its 200 day moving average below at 0.75568. The 200 hour moving averages between those moving averages at 0.75621. The current price is at 0.75656 and like the NZDUSD traders will be looking for a shove either above the 100 hour moving average above (at 0.75765), or below the 200 day MA below (at 0.7556).

- EURUSD: The EURUSD tried on at least six hourly bars to extend above its 200 hour moving average. However each time, the price extended a paper to above the moving average line, only to have sellers lean and push the price marginally lower. The 200 hour moving average has now moved below its 100 hour moving average. The 100 hour moving averages at 1.19338. The 200 hour moving averages at 1.19279. If the price is to go higher and tilt the technical bias more to the upside, getting above the 100 hour moving average at 1.19338 will be eyed. The current price is at 1.1923 into the close. On the downside the low for the day reached 1.19017 - just above the 1.1900. Move below that natural support level and there could be more down side momentum.

- GBPUSD: The GBPUSD like the EURUSD, has had a number of tries above its 200 hour MA over the last 4 trading days. Each break was met with little in the way of upside momentum. Today, there was one small break in the early European session. In the NY session, there was a test, but sellers leaned just below the level. That helped to push the price down from 1.3926 to a NY session low at 1.3870. That was right near the Asian session low. In the new day will take a move below that level and a swing area at 1.38535 to 1.38616 to increase the bearish bias.