Forex news for US trading on February 3, 2015:

- January 2016 US ISM non manufacturing PMI 53.5 vs 55.1 exp

- Fed's Dudley: Continued financial tightening would weigh on FOMC

- January 2016 US ADP employment report 205k vs 195k exp

- January 2016 US Markit services PMI final 53.2 vs 53.74 exp

- Iraq finance minister says OPEC working hard to cut production

- Special OPEC meeting to be held this month - WSJ

- OPEC & Non-OPEC meeting unlikely soon says Russia

- BOJ negative interest rate scope capped at 30T yen - Nikkei

- Bill Gross: Central banks are wrong and we're all doomed

- EIA weekly crude oil inventories +7792K vs +4000K expected

- US help-wanted online jobs rise 13.5K

- BOE's Baily says first task if UK leaves EU is to batten down the financial hatches

- Gold up $11.50 to $1140

- WTI crude up $2.42 to $32.30

- S&P 500 up 9 points to 1912

- US 10-year yields up 3 bps to 1.88%

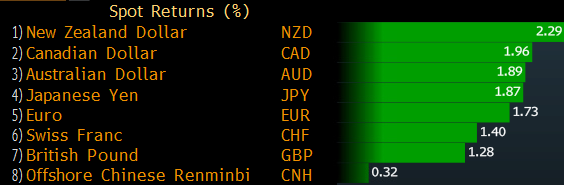

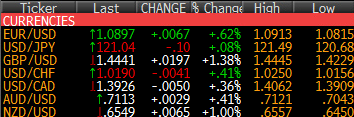

- NZD leads, USD lags badly

There are no easy answers for the massive rally in the US dollar. It started when the comments hit from Dudley, or just before. But there's nothing particularly dovish in what he said.

The soft ISM data definitely added to the dollar selling and cascading technical breaks, especially in EUR/USD, added to it.

At the moment, the Dollar Index is having its second-worst week since 2011.