From ANZ's most recent on gold:

- Despite calm returning to global markets, we expect safe-haven buying from rising geopolitical risks to continue to support gold prices. Aside from tensions with North Korea, President Trump has also signalled the he hopes to abandon the nuclear deal with Iran in coming months. However, the political risks are also having a significant impact on supply. Growth in mine output is at its lowest point since the financial crisis, with risks only getting greater. Thus we maintain our short term (3m) target of USD1300/oz for gold.

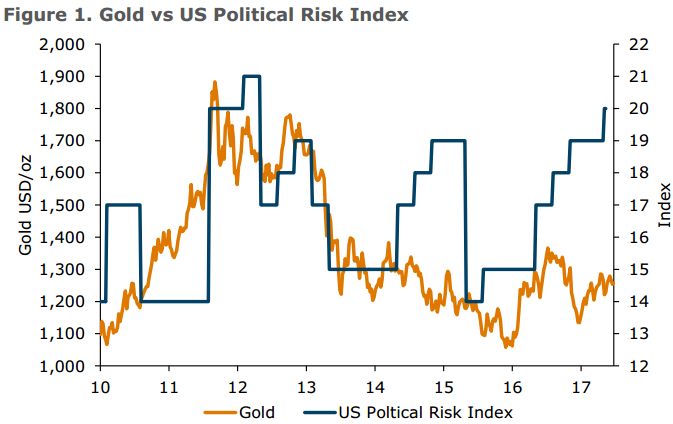

- Gold's status as a safe-haven asset has seen investor demand surge during periods of heightened risk. In recent times, however, President Trump's combative style has seen safe-haven buying reach a sustainably high level. With tensions around North Korea and Iran rising, this is unlikely to subside any time soon.

- However, political uncertainty has been impacting investment in supply. In fact, global mine supply has fallen in 2017. According to World Bureau of Metal Statistics, gold production is down 2% y/y in the first five months of the year. Production in May alone was down 3.1% y/y. With investment conditions remaining subdued, it's unlikely we'll see a rebound in mine supply soon.

(ANZ's note dated 17 August)