The BoE meet on September 14 (next Thursday) but the folks at GS have popped out a preview already

In brief (the main points):

BoE Preview - On hold amid a consumer slowdown, and despite further Sterling weakness

- We expect the MPC to vote 7-2 in favour of unchanged Bank Rate (at 0.25%) in its policy announcement on September 14. We expect a unanimous vote in favour of maintaining the stock of purchased assets at its current level.

- In the MPC Minutes, we expect the Committee to recognise the additional inflationary effect of Sterling's further 2% weakening in the past month.

- GDP growth is also tracking somewhat firmer than the MPC's August Inflation Report forecast. Our GS growth tracker ('RETINA') currently points to 0.6-0.7%qoq GDP growth in Q3, compared with the MPC's 0.3%qoq forecast in the Inflation Report. The unemployment rate has edged down further (albeit in line with the BoE's forecast). Nonetheless, there has been further evidence this month that the growth slowdown since the turn of the year has been focused on a weaker consumer. We expect the MPC to be especially sensitive to this component of its forecast, which encourages a more neutral message.

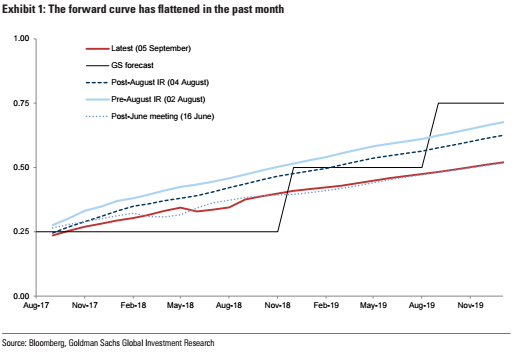

- We expect the Committee to reiterate its view that, given its outlook for the economy, "monetary policy could need to be tightened by a somewhat greater extent over the forecast period than the path implied by the yield curve". Indeed, the yield curve has flattened in the past month, reinforcing this point. We do not, however, expect either the BoE's Monetary Policy Summary or the Minutes to convey any additional urgency about getting that process of rate normalisation under way soon, beyond the two votes we expect for an immediate rate rise.

- We continue to expect a rate increase from the BoE in 2018Q4. Our own GDP growth forecasts are lower than those of the BoE. As the MPC 'waits and sees', we expect consumer spending to remain quite weak and for this to discourage the MPC from raising Bank Rate during the next year. Yet, relative to market pricing, and given the fall in Sterling forward rates in the past month, we expect a rate rise somewhat sooner than market pricing implies (Exhibit 1)