EURUSD continues to remain well bid so what's behind it?

Nothing much has changed on the US interest rate expectation front, the ECB are still printing away, Greece remains a boil on Europe's side awaiting some medicine or a good lancing, and the Eurozone economy is still waiting to spring to life

So why is the euro still going up?

With the Chinese stock markets having another crap out, falling 8.5% today, it looks like we could be seeing a continuation of the foreign exodus from Chinese stocks, despite China's best efforts to keep them afloat

One destination for those out flows could be the simple switch into Japanese stocks but Europe looks like it may be a big destination too

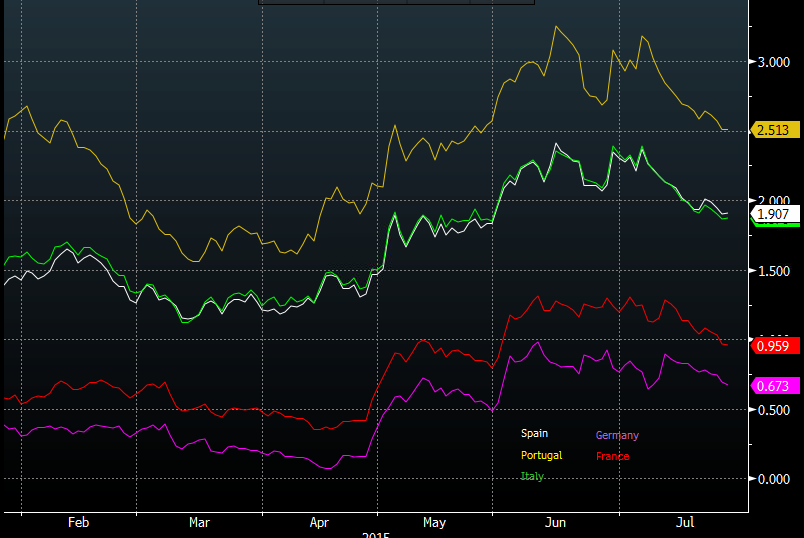

European yields have resumed their downward trajectory and considering that over the Greek crisis the ECB maintained their steady level of purchases, which didn't materially affect yields, it looks like other forces have been buying into European bonds. There's been a sharp decline in yields since late June and as I say, it doesn't look like the ECB is the main reason

European 10 year yields

When money comes out of one market it needs to find a home. The worries in China are adding increased risks for investors returns and so they tend to head for the hills and look for either safety or the next best thing. The problem they are finding is that there's limited high yielding options. US Treasuries are always an easy choice but when Chinese stocks went over, European yields were much higher and offered a more secure home and profit potential

Often investment flows just park up somewhere until a better opportunity comes along. If China's economy does settle then the flows will head back looking for higher returns. Until then the volatility in China is becoming too much for many to stomach and the virtual calmness of European bonds supported by the central bank looks as safe as it gets right now

There's certainly no real fundamental reason to buy the euro so I'm cautious on seeing these gains. If we do spring higher then that's likely to bring out the sellers who will want to take advantage of the higher price

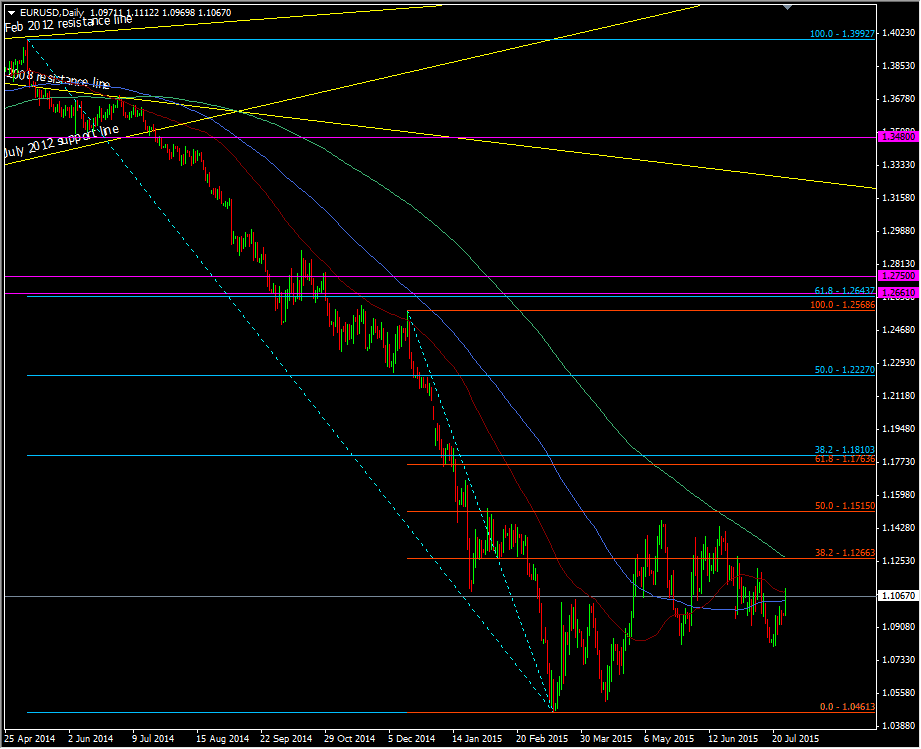

We're still very much in a sellers market and 700 pips away from the 38.2 fib of the 2014 high drop. That highlights the depth of the move that we couldn't even manage to get anywhere back near it. Even with the drop since December we're still 400 odd pips short of the 50 fib of that move

EURUSD daily chart

The only thing going against shorts is the fact that we are in a consolidation phase right now. That can mean that seller have extended themselves and have no inclination to push further down, or they are finding that the buyers are too strong for them. That 50.0 fib of the Dec move marks an important level as does the years lows around 1.0500/1.0460. To see the euro embark on it's next big journey either one of these levels needs to break. Until then this range is the one to play over the medium term