Here's one gap that's not going to close for a while

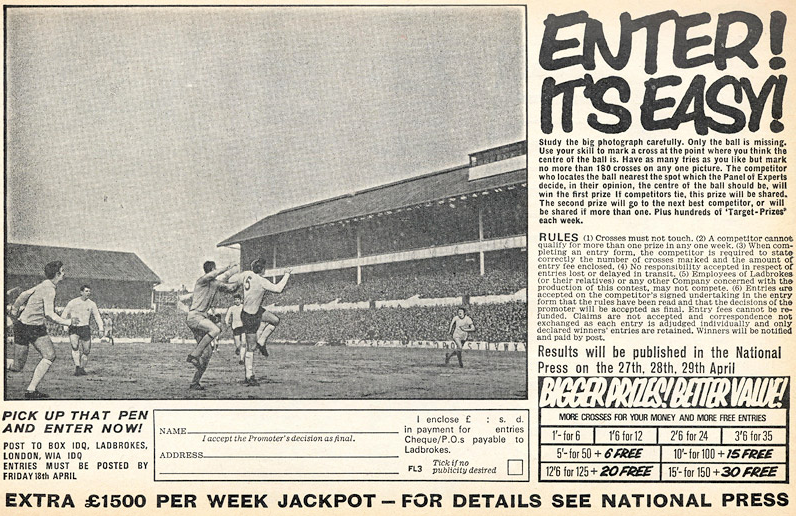

We have a game in the UK called 'spot the ball'. It used to be big in the papers and a weekly subscription competition called the Football Pools.

I've been reminded of that game today when trying to find where Greek 10 year yields are on the chart

Greek 10 year yields

Naturally yields are higher on the vote result, as are most yields in Europe outside of the safety zones like bunds and gilts. Even France is finding safe haven flows as the market starts thinking about contagion

It's going to be important to watch yields in relation to the currency as if they become too volatile then the ECB is likely to step in to calm the market down, which could support the euro. Under normal circumstances the ECB buying under QE would be euro negative on the basis that it's easing. Under these circumstances it's more to do with propping up financial stability and that might turn the euro trade on its head

There's difficult times ahead and correlations and trading patterns that worked one minute may not work the next