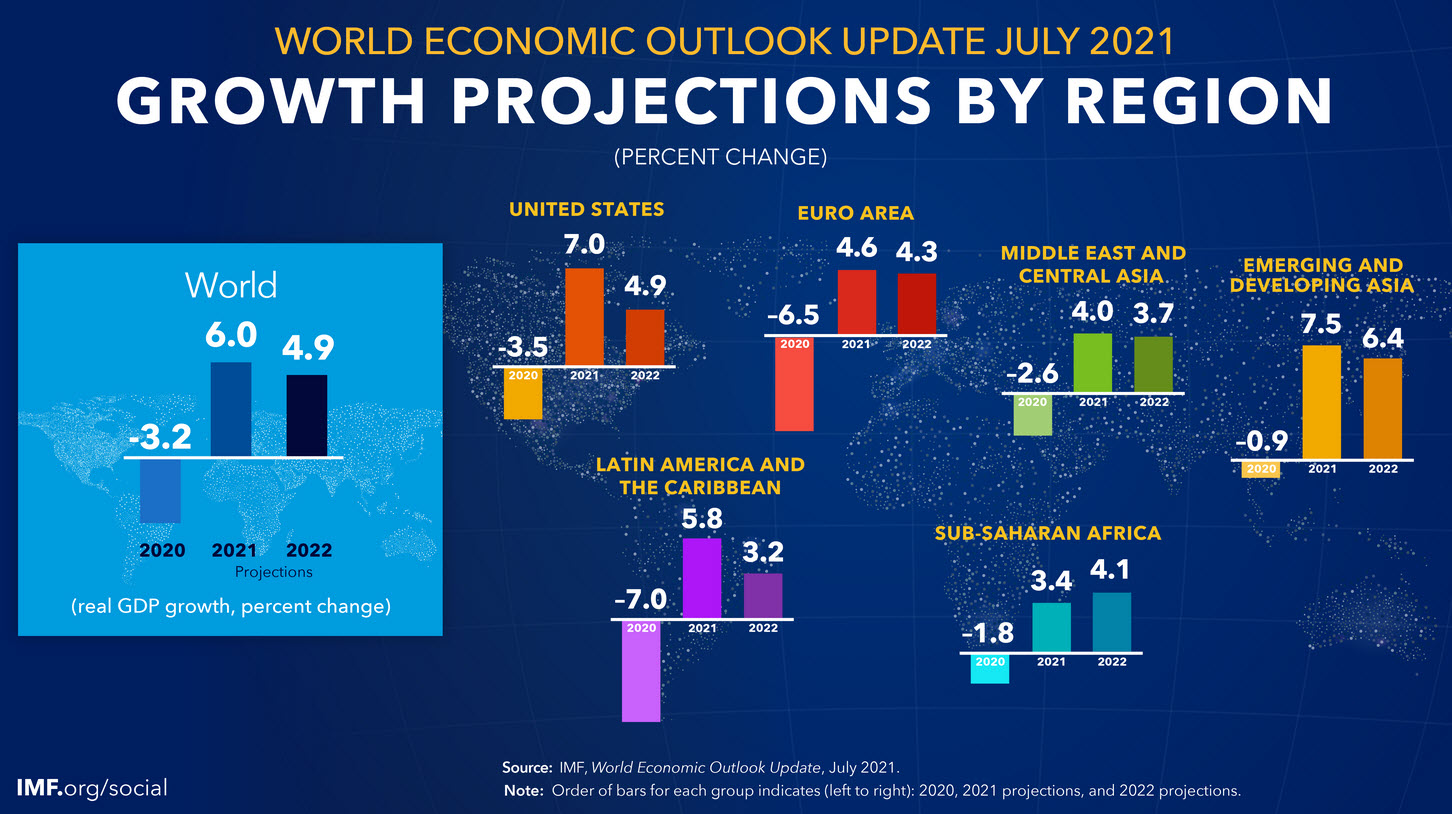

The latest growth estimates from the IMF

- 2021 will be the strongest year since 1976

- 2022 GDP to 4.9% from 4.4%

- US growth to 7.0% vs 6.4% in April forecast; 2022 at 4.9% vs 3.5% prior

- Eurozone growth 4.6% vs 4.4% in April forecast; 2022 at 4.3% vs 3.8% prior

- Japan 2.8% vs 3.3% in April; 2022 3.0% vs 2.5% prior

- Canada 6.3% vs 5.0% prior; 2022 4.5% vs 4.7% prior

- China 8.1% vs 8.4% in April; 2022 at 5.7% vs 5.6% prior

- India 9.5% vs 12.5% in April; 2022 at 8.5% vs 6.9% prior

- UK 7.0% vs 5.3% in April; 2022 at 4.8% vs 5.1% prior

- Recent prices pressures reflect pandemic-related developments and transitory supply-demand mismatches

- New variants and lockdowns could shave 0.8 pp form 2021 and 2022 GDP growth

- Risks around the global baseline are to the downside due to vaccines rollout and inflation

- Full report

The IMF said divergences in developed and emerging economies primarily reflects access to vaccines and continued fiscal support. The headline from the report was 'fault lines widen in the global recovery'.

Here's a comment on inflation:

Despite a recent uptick in wage growth in the United States, wages of individuals-observed 12 months apart in the Atlanta Federal Reserve's Wage Growth Tracker-do not indicate broader pressure in the labor market. Data from Canada, Spain, and the United Kingdom show similar patterns of broadly stable wage growth this year

They see three reasons that inflation will diminish:

- labor market slack remains substantial

- Inflation expectations are well anchored

- Structural factors