Better but not spectacular growth in Europe may take a little heat off of the Dec ECB meeting

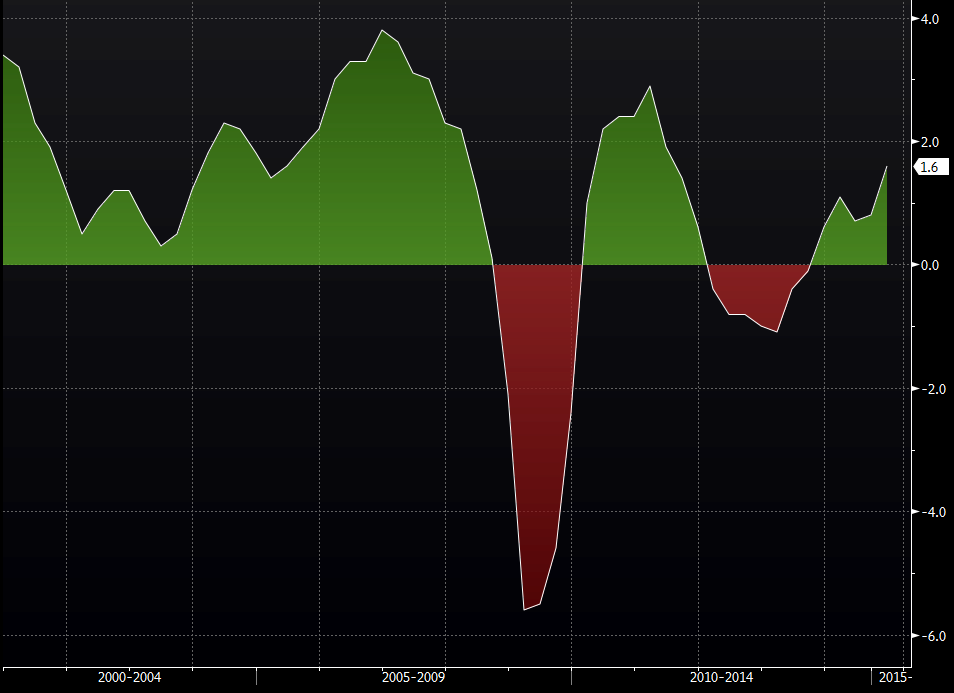

1.6% growth may not have any champagne corks popping but 1.6% is better than the -1.1% low seen in 2013. Take that into account and you can see that the Eurozone recovery is plodding along

Eurozone GDP

That trend will be welcome news to the ECB but they know it's still on very fragile ground. irrespective of the tick up in y/y GDP today, that's unlikely to change what happens at the Dec ECB meeting. It may have the fence sitting members squawking a bit louder but the ECB is all about the price mandate. I don't think they'd take much notice of GDP at 3.0% while inflation remains at these levels

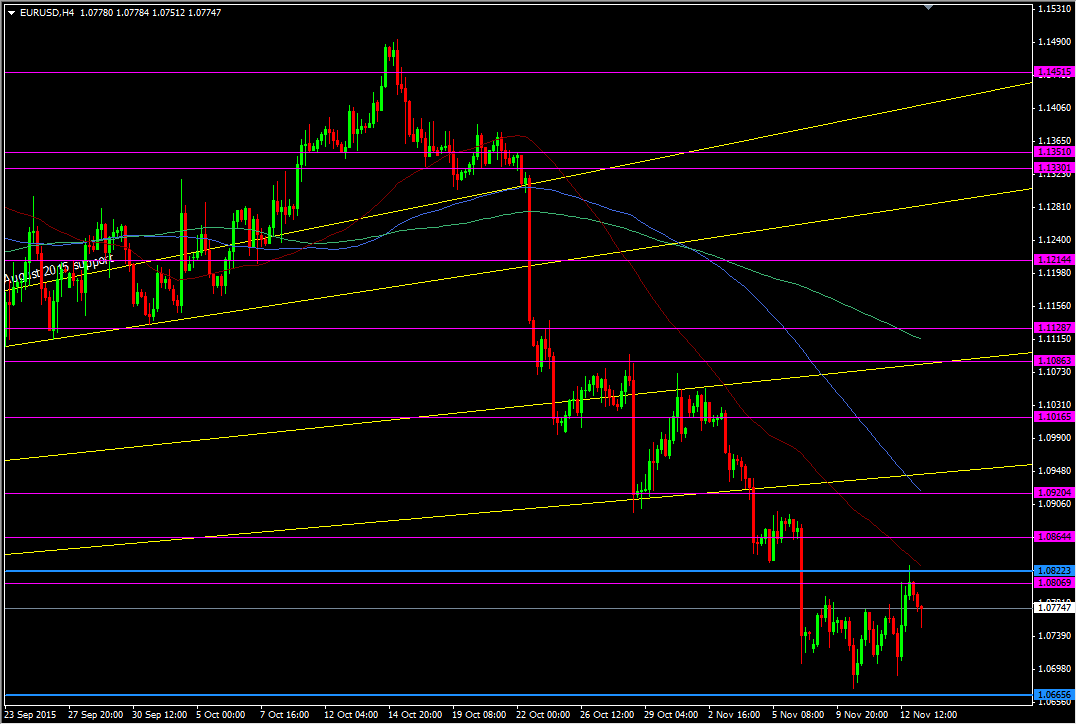

At best the data hasn't increased the risk of further ECB action and for now it's put a base in the euro at 1.0750

1.0800 has become resistance again after the quick shopping trip above yesterday but old teflon is still keeping itself above 1.0700 and it's becoming an increasingly important level

EURUSD H4 chart

With US retail sales the big number today, that could well be put to the test once again if they're good. How it reacts in the minutes after any initial reaction will be important. If we zip through and bounce back above quite quickly then could be another failure. If we find that the market keeps the price below then that's a signal for seeing more downside

Likewise, on the upside we'll be watching 1.0800/1.0820/25 for signs of a break up there. I'm going to be watching the 1.0700 level for a trade opportunity and I would prefer to play a long on a hold (or if we dip below then retake it) rather than a short on a break