From JP Morgan’s Key Currency Views client note from Friday, their view on euro. They start by asking …

Although EUR/USD is down almost four cents from its 2014 high, many ask why it isn’t even lower considering the ECB easing package announced June 5 (a 10bp cut in the refi, a negative deposit rate of -10bp, an end to SMP sterlisation, a series of quarterly LTROs through June 2016)

They say:

- The short answer is that these measures don’t ease monetary conditions that much

- At least not this year

- Conventional rate cuts achieve little when eonia rates have been near zero for so long; the first two TLTROs in September and December may have limited take up before European banks digest the AQR and stress test results later in Q4; and subsequent TLTROs will partly refinance the roughly €450bn in 2012 operations maturing early next year, thus limiting the net expansion in the ECB’s balance sheet.

- For now, we still see the ECB’s decision as one which increases our confidence in end-2014 and 2015 baseline targets rather than an event justifying ever lower projections.

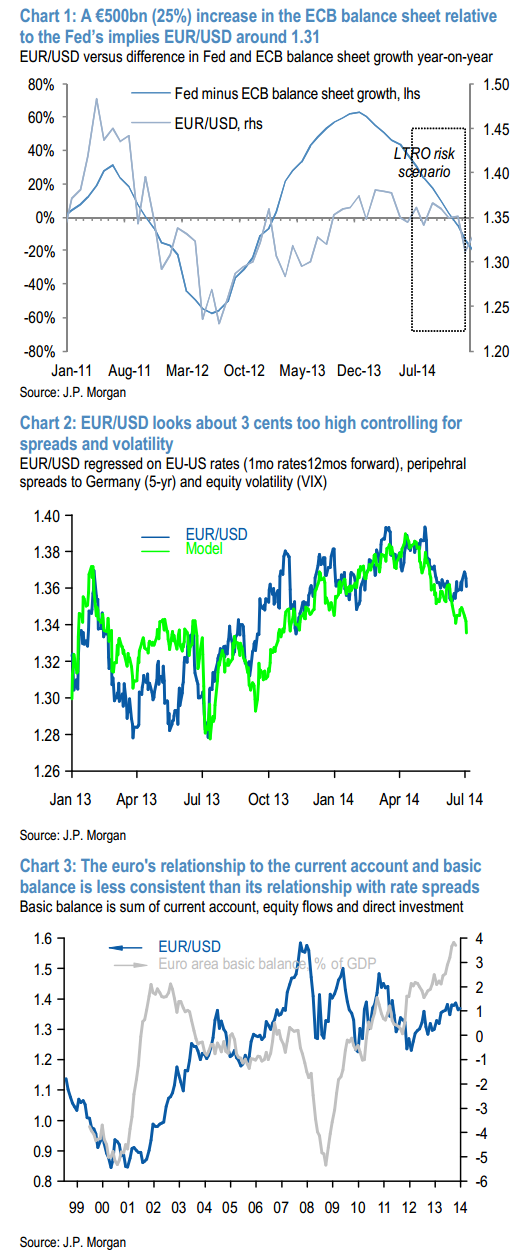

- As shown in chart 1, however, a substantial increase in the ECB’s balance sheet on a net basis over the next year (assume €500bn) would be worth about five cents of additional decline relative to the baseline forecast

- With ECB’s balance sheet unlikely to expand much on a net basis this year, euro depreciation is still mostly about higher US front-end rates

- The 1.30 year-end target we have maintained all year was based on a US 2-yryield forecast of 0.9% and the euro’s historical sensitivity to a rate move of that magnitude. Indeed US rates are moving in the expected direction and the euro has slipped, but it should be about three cents lower if the historical betas held (chart 2).

- Potentially the currency’s resilience owes to Europe’s record surpluses on the current account (+2% of GDP) and the basic balance (current account plus long-term capital flows (+4% of GDP). But since cyclical drivers like rate spreads have tended to influence the euro more than structural ones like the current account or basic balance (chart 3) when put through multi-variable models, we’ll characterize the euro’s stickiness as a familiar overshoot which will correct itself in coming months if the US rates story develops as we expect.