- Prior 0.7%

- 11.8% vs 11.2% exp y/y. Prior 11.1%

- Average price £188.9k vs £186.5k prior

- Seasonally adjusted house prices reached 2007 peak in Q2

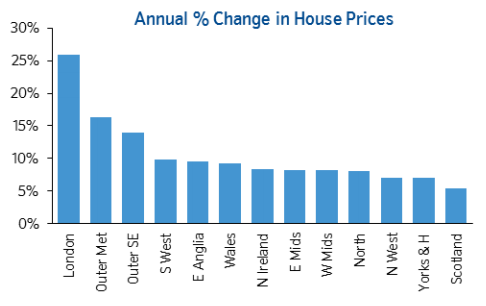

- London annual prices rise 26%

“The Financial Policy Committee’s decisions to limit the proportion of lending at or above 4.5 times borrowers’income to no more than 15% of new loans1 and to introduce a stress test to ensure that borrowers can afford a three percentage point increase in Bank Rate are unlikely to have a significant impact on housing transactions or the pace of price growth in the near term.” said Nationwide’s chief economist Robert Gardner

“However, these policy measures, along with previous actions, such as the introduction of Mortgage Market Review (MMR) measures, should help to limit the risk of house prices becoming detached from earnings without de-railing the

recovery in the wider housing market.”

Nationwide house prices 02 07 2014

It’s going to be difficult to judge the market between now and when the new rules come into effect in October but I suspect we’ll see a rush to get in before the deadline.

Cable trots up to 1.7156 from 1.7146

Nationwide house prices yy 02 07 2014