June seasonals were solid not spectacular

Around the start of every month, we bring you a few seasonal patterns to watch. June signals weren't terribly strong but we offered four ideas (Four June seasonal trends to watch for). Let's look at how we did.

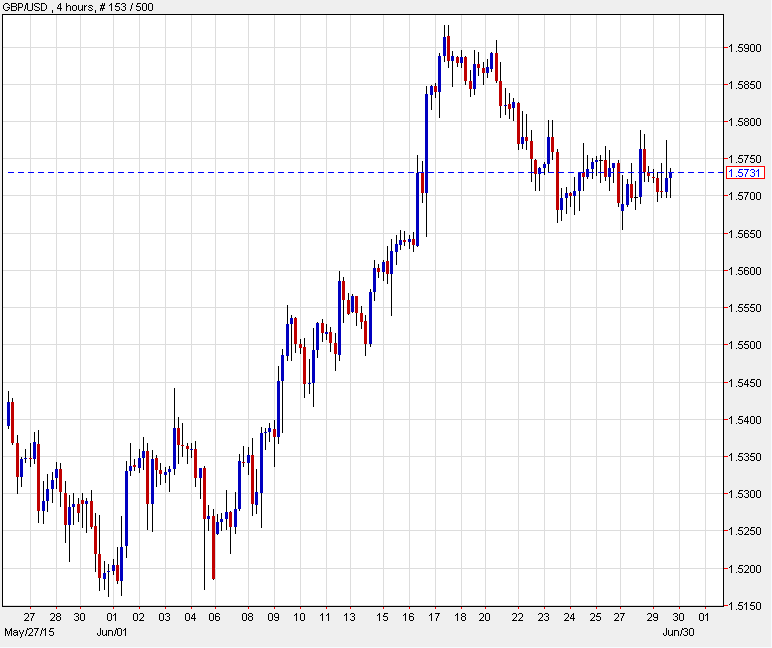

#1) Mild GBP strength

What we said: "June and July are two of the top months for cable. The pound is stuck in a two week downtrend and has erased the post-election gains. But support is nearby at 1.5100..."

What happened: The monthly low was set on June 1 at 1.5163. The strength was much more than 'mild' as cable rose as high as 1.5929 on June 17 before settling at 1.5728. It was the top G10 currency performer in June.

#2) Better days ahead for AUD

What we said: "The June-July period is also a better time for the Australian dollar as it leaves a wretched two weeks behind."

What happened: The good news is that the low for the month was on June 1 at 0.7597 and it rose as high as 0.7850. The less-good news is that we're only closing the month up 0.82% at 0.7709. This was more of a base-hit than a home run.

#3) Stocks on the rocks

What we said: In the past 30 years, June is the third worst month on the calendar [in the S&P 500] but just looking back at the past decade, it's easily the worst."

What happened: Stocks were up and down throughout the month but heavy selling the past week knocked the S&P 500 lower by 2.2%. Score that a win.

#4) Oil the gears

What we said: "The standout seasonal trend in June is oil strength. I'm a major oil bear but the seasonals, along with the three candle reversal that was completed on Friday preach caution. June and July are two of the better months for crude, especially over the past decade. Ultimately, oversupply will be the dominant driver of crude prices but not quite yet."

What happened: Oil declined 2.2% in the month. Overall, crude remains stuck in a major $57-$62 range. Score this one a loss but my point was to be patient in selling crude and I standby that.

Up next: What's in store for July forex seasonals?