New Yorkers of a certain age will remember the catch-phrase of sportscaster Warner Wolf, who began every highlight with “let’s go to the video tape…”

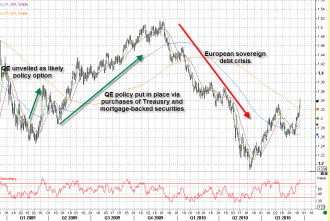

Let’s look back to the market’s reaction to the Fed’s December 2008 statement that opened the door for QE 1.0.

Bernanke announced the Fed was considering QE on December 1,2008. EUR/USD closed at 1.2720 that day. The Fed announced officially that it would focus its future monetary policy on the size of the Fed’s balance sheet on December 16 (i.e buying assets or QE). EUR/USD closed at 1.4048 that day. It peaked at 1.4720 two days later.

After that, EUR/USD eased back to 1.2457 lows in early March 2009 before beginning to rise again. (The lows coincided with the release of the US bank stress tests). $1.7 bln of QE was announced at the March 18 meeting. EUR/USD jumped to from 1.30 to almost 1.35 that day and began a trend that ended in late November at 1.5145.

If we follow a similar pattern as last time, we should rally a few more days before retrenching into the November FOMC we a rally would resume, should history repeat itself.